Personal loans increasingly used by financially vulnerable consumers, J.D. Power report says – here’s why

by J.D. Power Lending on Aug 1, 2022 11:27:00 AM

J.D. Power's report said personal loans serve as a gateway to other financial products

38% of vulnerable consumers have used a personal loan: J.D. Power survey

by J.D. Power Lending on Jun 1, 2022 11:22:00 AM

The data analytics company found that consumers are increasingly turning to personal loans.

Fewer Opportunities Require Auto Lender Sales Reps to Exceed Dealer Expectations

by Patrick Roosenberg on Apr 27, 2022 1:50:43 PM

The J.D. Power Canada Dealer Financing Satisfaction Study is the most in-depth, independent survey of automotive dealer personnel and their evaluations of captive and non-captive financing providers. The 2022 edition of the study will release to subscribers on May 5, 2022, and J.D. Po …

How do lenders stay top of mind with dealers with less on-site visits?

by Patrick Roosenberg on Apr 21, 2022 3:25:49 PM

The J.D. Power Automotive Finance Team is excited to share some sneak peek insights from the 2022 Canada Dealer Financing Satisfaction Study. Subscribing clients will receive access to the data on May 5, 2022, and J.D. Power will issue a press release with rankings and key findings on …

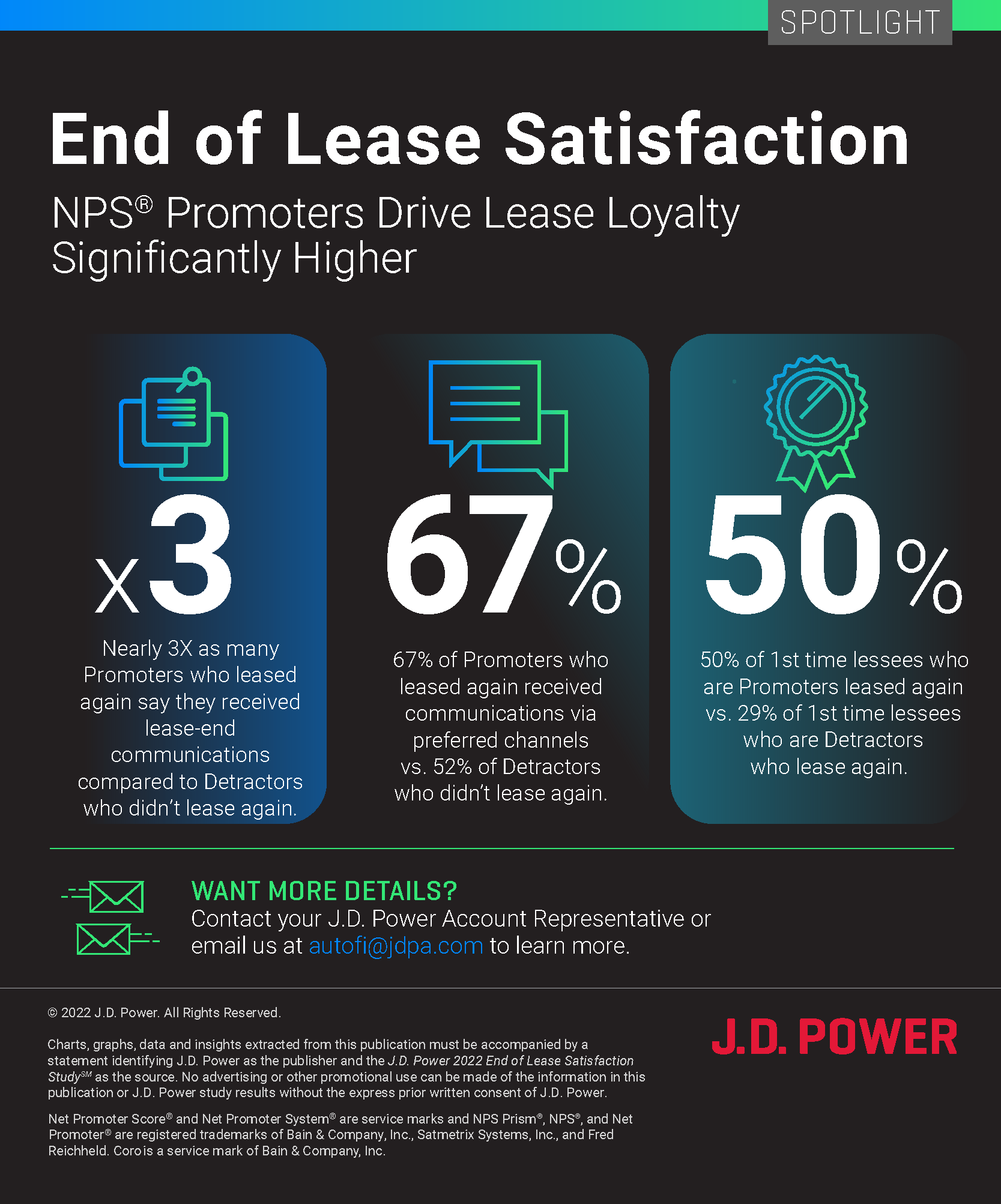

NPS Promoters Drive Lease Loyalty Significantly Higher

by Patrick Roosenberg on Mar 9, 2022 4:30:27 PM

The J.D. Power Automotive Finance team is excited to share some sneak peek insights in anticipation of the upcoming release of the J.D. Power 2022 U.S. End of Lease Satisfaction Study.

Opportunities To Win Auto Financing Customers Begin Before They Step Foot In A Dealership

by Patrick Roosenberg on Oct 27, 2021 12:19:42 AM

Pre-approvals gain traction and are highly effective as 60% of customers applied for pre-approval after researching on-line, according to initial findings from the upcoming J.D. Power 2021 Automotive Consumer Financing Satisfaction Study

Effectively Competing for Mortgage Customers in 2022 and Beyond

by J.D. Power Lending on Oct 26, 2021 9:02:08 AM

Despite huge investments in technology, most mortgage lenders have struggled to find the right balance in human and digital to effectively compete in the future. Facing fierce competition, a rapidly increasing pace of change and shrinking margins, lenders can’t afford to guess about h …

What Influences Auto Financing Consumers During the Shopping Process?

by Patrick Roosenberg on Oct 20, 2021 10:54:57 AM

What influences and shapes the preferences and decisions of customers throughout the entire automotive financing process?

Delivering a Differentiated Borrower Experience

by J.D. Power Lending on Oct 18, 2021 11:12:23 AM

The world has changed in the past two years and future homebuyers have a new set of expectations. J.D. Power’s 2021 Primary Mortgage Origination Study publishing on Tuesday, November 2nd takes a hard look at what matters most to today’s borrowers.

J.D. Power 2021 Consumer Finance Study Publishes Soon

by Patrick Roosenberg on Oct 13, 2021 5:54:29 PM

The J.D. Power Automotive Consumer Financing Satisfaction Study is the most comprehensive independent study of borrowers who financed a new or used vehicle through a loan or lease. We created this study to better understand customer intentions, priorities, influences, and preferences …

Focus on the Fundamentals and Move Beyond Transactional

by Patrick Roosenberg on Sep 15, 2021 1:19:53 AM

Dealer satisfaction is up for the industry since 2020, however, the 2021 J.D. Power Dealer Financing Satisfaction study finds that 25% of dealers indicate they are receiving a less than desirable experience. This is particularly important because dealers tend to send more contracts to …

Competitive Intelligence Drives Competitive Advantage

by Patrick Roosenberg on Sep 9, 2021 4:45:22 PM

In a market constricted by supply challenges and increased demand, critical intelligence on the current auto finance market and competitive landscape is more important than ever. Dealer feedback provides a starting point to design and launch initiatives that capture greater-dealer sat …