Bill Streeter, Editor at The Financial Brand interviewed Paul McAdam, Senior Director of Banking Intelligence at J.D. Power to discuss key findings of the latest edition of the J.D. Power National Bank Satisfaction Study.

Here are some highlights:

- There’s little in banking that the global pandemic hasn’t affected. Maintaining satisfaction with customer experience ranks highly on the issues affected by COVID-19, and two sub-issues have arisen as consumers have had to adjust their banking habits to COVID realities: “Efficient digital channels” (website and mobile app) and “Allowing people to bank how and when they want.” The latter is a function partly of need, partly of preference.

- Superior digital banking offerings, clear products that match customer needs and helping customers save time and money are becoming key differentiators for the country’s largest retail banks.

- Banks that have been most effective in managing the transition to a digital-first model have earned high marks for customer satisfaction in a year when mobile apps and websites have become a vital lifeline for banking customers.

- J.D. Power data also indicate that strong digital offerings have the added benefit of helping customers improve or maintain their financial health, a key feature in a time when so many are experiencing economic distress.

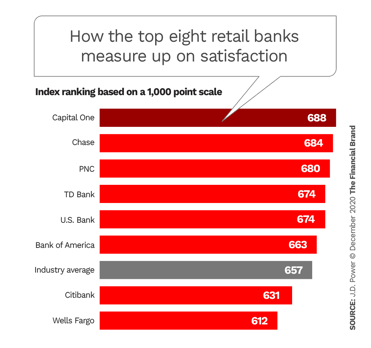

So how did the largest banks in the United States rank when it comes to customer satisfaction in 2020?

Read the full article to learn more about how customer satisfaction impacts banks' bottom line, why some banks score lower, branch and digital channel insights and advice as a still largely untapped opportunity.