Share this

From the Vault: High Marks for Digitally Oriented Banks as Americans’ Financial Health Shaken During Pandemic

by Paul McAdam on May 11, 2021 1:48:42 PM

As the country moves into recovery and we prepare to share the results of the inaugural 2021 J.D. Power Financial Health and Advice Study on June 16, 2021, we wanted to share insights around the state of Americans' financial health amid the pandemic published last October.

J.D. Power Financial Services Insight

October 2020

High Marks for Digitally Oriented Banks as Americans’ Financial Health Shaken During Pandemic

Many consumers continue to experience financial stress, as the U.S. economy fights its way back from the pandemic-driven slowdown. The state of Americans’ financial health remains challenged, according to J.D. Power surveys of 12,000 U.S. consumers conducted in July, August and September 2020.

- In September, 33% of U.S. consumers said they did not have enough cash to cover living expenses and only 58% said they had enough money on hand to cover a $500 emergency.

- 44% say their stress level regarding their financial situation has “gone up” over the prior few weeks.

- 38% say their household income has declined by at least 25% since the pandemic began.

The bottom line is that only 44% of American consumers are financially healthy, meaning they live with the stability of income exceeding expenses and are fully able to meet basic financial needs, such as paying bills on time, having a savings reserve and having adequate insurance coverage (medical/health, property, auto). A majority (56%) of American consumers are not fully financially healthy, citing varying degrees of financial stress and vulnerability that range from struggles with credit and with building a

savings reserve to severe difficulties paying their daily bills. Younger consumers, particularly those age 18 to 34, are less likely to be financially healthy than older consumers.

What do these trends mean for America's retail banks, and which banks are doing the most to help their customers in this period of heightened economic stress? Our data shows that a handful of retail banks are significantly outperforming their peers when it comes to solutions to help customers improve their financial health. Perhaps not surprisingly, those with strong digital capabilities are leading the way.

Retail Banks Have Important Role to Play

The COVID-19 pandemic has increased economic and health-related stress experienced by tens of millions of American consumers. Retail banks can play important roles in helping consumers recover and rebuild financial health. Our data shows the consumer audience is highly receptive. More than threefourths (83%) of American consumers are interested in receiving advice or guidance from their primary retail bank, and since the pandemic’s start:

- Consumers’ use of advice/guidance provided by the retail bank increased, particularly when related to helping consumers keep track of their finances and accumulate savings for a large purchase or goal.

- Consumers cite higher incidences of receiving advice/guidance from their banks’ digital channels (email, web or app), while incidences of receiving advice from bank branches has plunged.

Consumers are increasingly looking to their banks and to digital channels to obtain practical advice and guidance to help them manage spending, budgeting and saving. Understanding these dynamics places banks in a better position to provide timely and relevant advice that meets customer needs and is acted upon.

Bank of America and Capital One Performing Well

Among the customers of the top 10 U.S. retail banks1, Bank of America and Capital One tie for having the highest levels of support for their customers’ financial health. Customers rate Bank of America and Capital One the strongest at helping them make better decisions, manage their spending, meet their savings goals and meet their credit and borrowing needs. Relative to their top 10 bank peers, customers of these two banks are more likely to want their bank to help improve their financial health by providing money management education, tools to create a budget, and information to help them understand their credit score and credit worthiness. The data clearly suggests that Bank of America and Capital One are meeting these customer needs.

Among the top 10 retail banks, J.D. Power’s research of the retail banking customer experience consistently demonstrates that Bank of America and Capital One have the youngest and the most digitally centric customer bases (i.e., customers who may use branches lightly, but primarily use online or mobile banking). Younger and digitally centric customers are less financially healthy and more likely to seek advice/guidance than their older and branch-oriented counterparts. Among customers under 45 years of age, Bank of America and Capital One have wide leads over their top 10 banks peers in helping customers manage their spending and meet their credit and borrowing needs. In addition, Capital One performs particularly well at helping customers under age 45 meet their savings goals, while Bank of America excels at helping customers in this age group make better financial decisions.

For years, Bank of America and Capital One have been clear about their strategies to advance digital transformation beyond transactions into essential customer journeys, such as understanding and improving one’s financial health. In addition to digital banking and credit card management tools, these strategies have evolved to include a wide array of financial health education and content that helps customers improve financial literacy and gain greater control over their finances. Bank of America’s Better Money Habits® and Capital One’s Learn and Grow are successful examples of programs that help customers develop healthy financial habits. Bank of America’s and Capital One’s strong customer

satisfaction with their support of customers’ financial health suggest the makings of sustainable strategic advantage.

Good for Customers and Good for Business

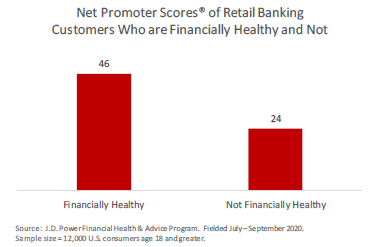

Many retail banking customers recognize relevant bank communication about improving financial heath to be advice or guidance. J.D. Power studies in retail banking consistently demonstrate that metrics like overall satisfaction, Net Promoter Score®2 and likelihood to reuse a brand improve when customers feel their bank has provided advice or guidance. Additionally, customers who are financially healthy are far more satisfied with and more likely to promote their primary retail bank.

The data paints a clear picture. The pandemic has shaken the financial health of many Americans. Communications and interactions that enable consumers to better understand and manage their financial health are of growing strategic importance. On average, financially healthy customers are better banking customers. They use more banking services and provide banks with new opportunities to increased engagement, loyalty and long-term revenue streams. Helping consumers lead financially healthy lives is ultimately more profitable for the banking industry.

Methodology and Footnotes

J.D. Power’s research of the financial health of banked American consumers is based on three months of monthly surveys resulting in 12,000 survey responses. Data was collected on July 16-19, Aug. 5-9 and Sept. 10-14, 2020.

1 The top-10 U.S. retail banks, based upon domestic deposits, are: Bank of America, Chase, Wells Fargo, Citi, U.S. Bank, Truist Financial (includes the BB&T and SunTrust brands), PNC, TD Bank and Capital One.

2 Net Promoter,® Net Promoter System,® Net Promoter Score,® NPS,® and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.

Find out More

This J.D. Power Industry Insight was authored by Paul McAdam, Practice Lead for Banking & Payments at J.D. Power. Please contact the numbers below to learn more about the underlying research or to schedule an interview.

Media Contacts:

Brian Jaklitsch; East Coast; 631-584-2200; brian.jaklitsch@jroderick.com

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com