The J.D. Power Automotive Finance Practice is releasing a sneak peek of the insights from the study ahead of the press release. Over 3,500 car dealer personnel were surveyed to uncover drivers of greater dealer satisfaction and understand lender actions that drive future intent.

2022 J.D. Power U.S. Dealer Financing Satisfaction Study

The J.D. Power U.S. Dealer Financing Satisfaction Study is the most in-depth, independent survey of automotive dealer personnel and their evaluations of captive and non-captive financing providers. The study identifies key dimensions of satisfaction among dealers with their lenders and recognizes strengths and opportunities for improvement against competitors. The 2022 edition of the study releases to subscribers on August 4, 2022, and J.D. Power will issue a press release with rankings and key findings on August 11, 2022.

Sneak Peek of the Results

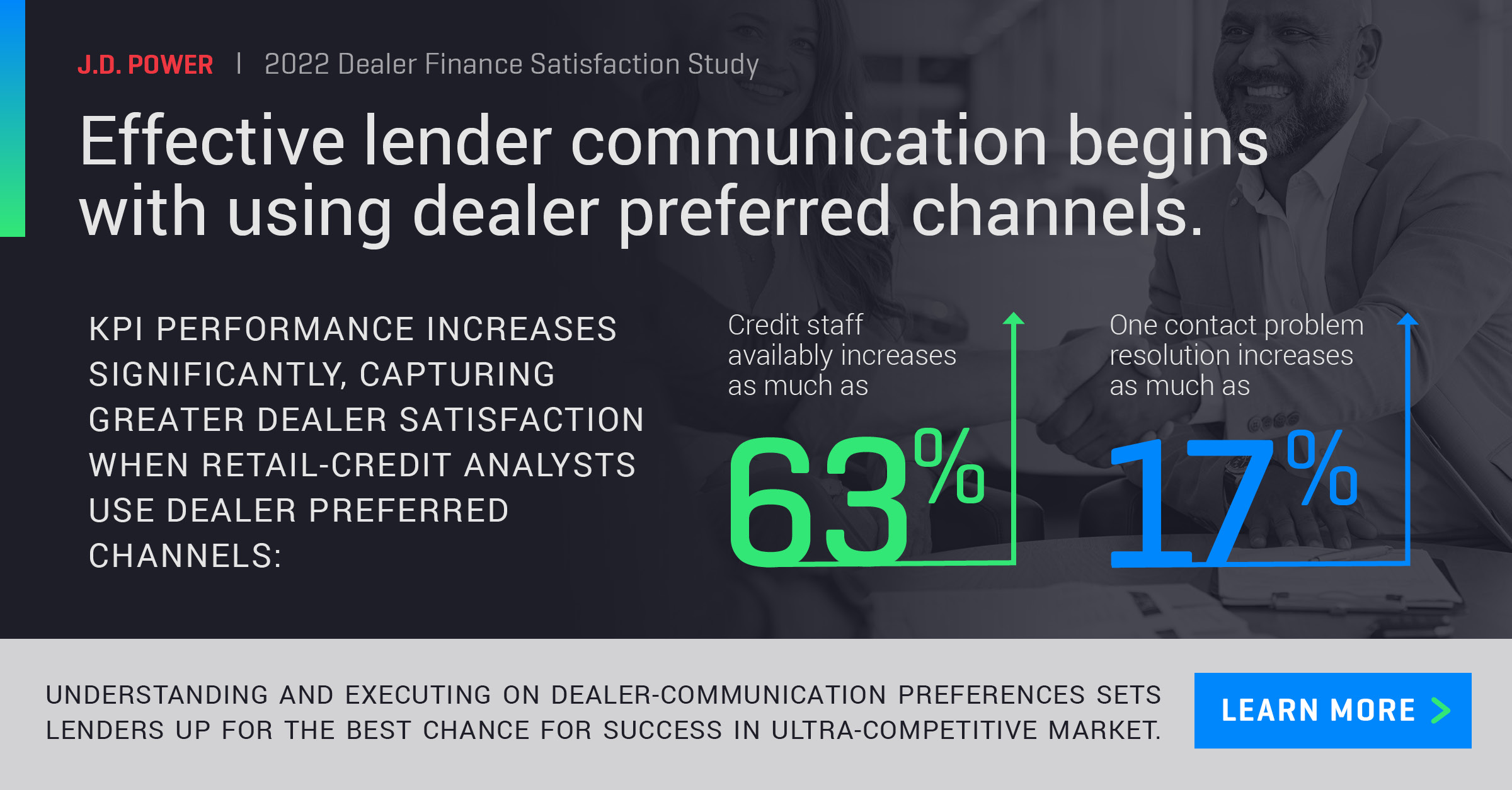

The early findings indicated that effective lender communication begins with using dealer-preferred channels.

When retail credit analysts use their dealer’s preferred channel of communication, KPI credit staff availability increases as much as 63%. Additionally, one contact problem resolution KPI increases as much as 17%.

The results show that lender differentiation opportunities remain within the industry. Understanding and executing dealer-communication preferences set lenders up for the best chance for success and capturing incremental business.

Enjoy the Sneak Peek?

Subscribing clients will receive early access to the data on August 4, 2022, and J.D. Power will issue a press release with rankings and key findings on August 11, 2022. Join our mailing list to see additional previews of the data. Contact your J.D. Power representative or email autofi@jdpa.com to discuss how these findings impact your business.