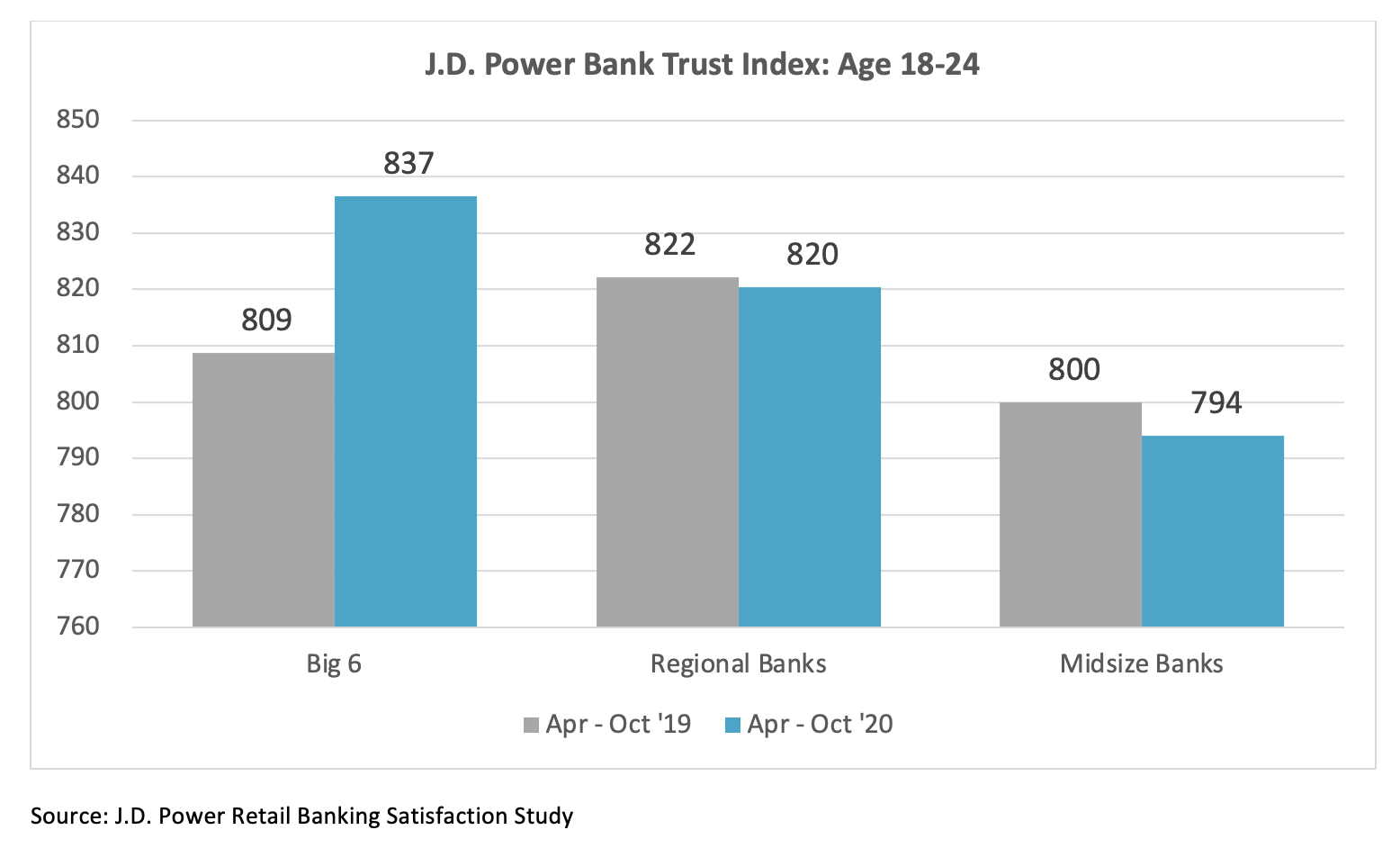

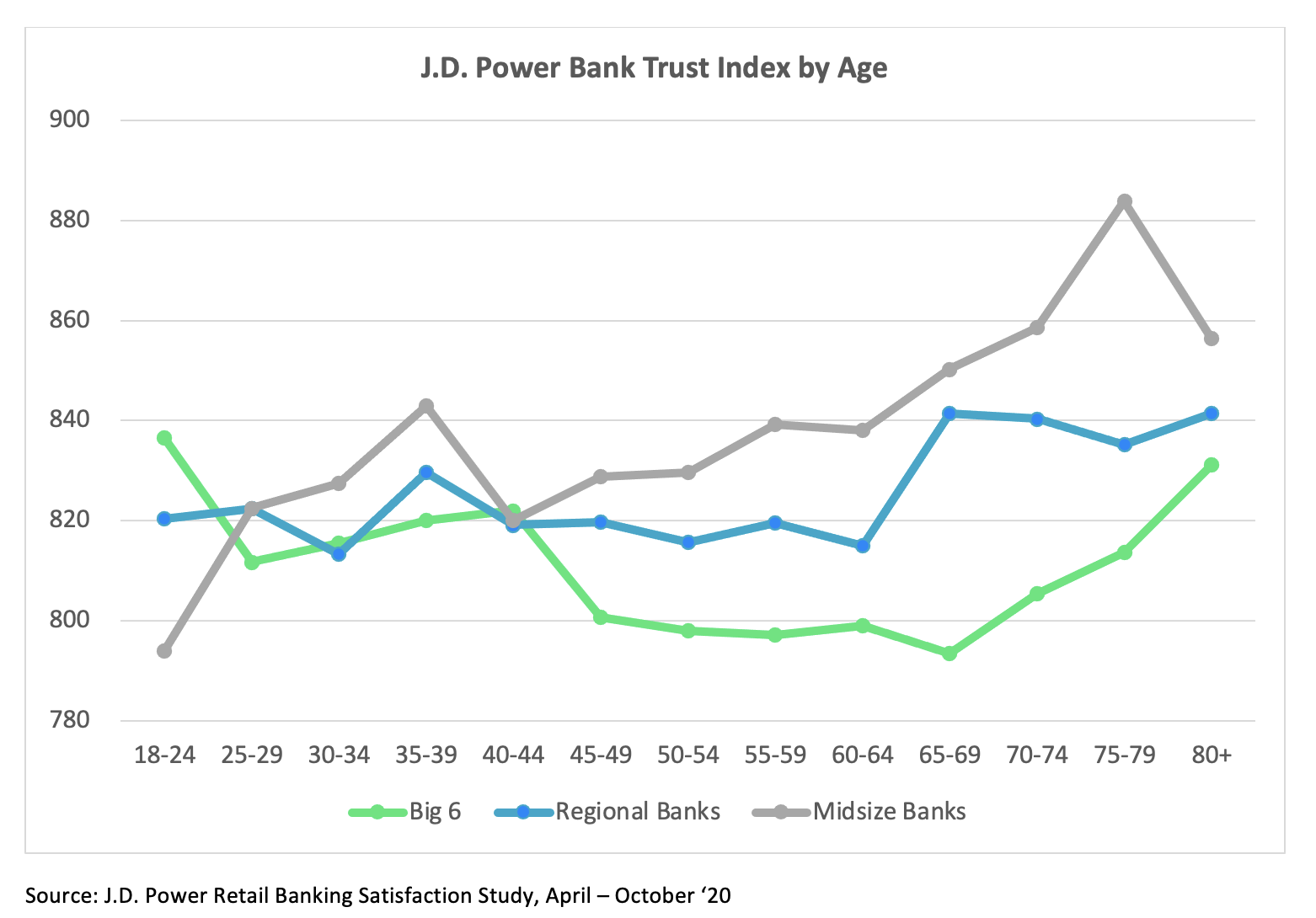

During the pandemic, big banks are winning the trust of the youngest adult bank customers. Among 18-24-year-olds trust with the Big 6 Banks increased from 809 (1,000-point scale) in 2019 to 837 in 2020. The Big 6 Banks include Bank of America, Chase, Citibank, PNC, U.S. Bank and Wells Fargo. During the same period trust declined by 2 points at Regional Banks and 6 points at Midsize Banks. Midsize Banks continue to lead in overall trust, especially among customers 45 and older, but should be concerned about the lack of trust with young customers.

With 18–24-year-olds, the Big 6 Banks greatest advantage is in “provides reliable technology” where they lead Midsize Banks by .75 points (10-point scale). The Big 6 also rate higher on “protects my personal identify” by .52 points and “is easy to do business with” by .47 points. More surprising, the Big 6 are ahead of Midsize Banks by .48 points in “provides honest communication with me,” .38 points in “provides useful guidance and/or advice” and .26 points in “doesn’t have hidden charges or fees.” While the technology lead for big banks has been evident for years, Midsize Banks should be very concerned about the trust gap that is emerging with young customers in areas such as honest communication, providing advice and not having hidden fees. Midsize Banks and Regional Banks need to develop and implement plans to win back the trust of their young customers.

The J.D. Power Bank Trust index is based on ratings from over 20,000 bank customers each quarter. The index consists of 7 questions in which customers rate their primary:

- Puts the interests of customers first

- Provides useful guidance and/or advice

- Provides honest communication with me

- Provides reliable technology

- Is easy to do business with

- Protects my personal identify

- Doesn’t have hidden charges or fees

News We are Following

Dollar General plans to open 1,050 stores this year. Banks are announcing branch closings and online retail has exploded during the pandemic. It’s interesting that Dollar General is building bigger stores while expanding its Popshelf brand which is aimed at higher income, suburban customers. For some customers, physical locations still matter.

Zoomless Fridays at Citi. Jane Fraser is already making a big mark at Citi. To promote a healthier work-life balance, Citi is banning internal video calls on Fridays. Video calls will still take place with clients and regulators and employees will conduct meetings by telephone.

Would you spend $69 Million for a JPEG? A digital image by the artist Beeple just sold for $69,346,250. Well, actually the purchase was made in ether for a non-fungible token (NFT), or a certificate of authenticity for the digital file. The buyer doesn’t even get a copyright or reproduction rights, just bragging rights. Twitter CEO Jack Dorsey sold an NFT on his first tweet for 1,630.58 ether. The value of the ether was $2.5M when the order was placed and $2.9M at the time of the sale. Dorsey is going to convert it to bitcoin and then donate it to charity.