J.D. Power Polaris monthly reports look at today’s banking and card customer through the lens of their financial health. J.D. Power’s inaugural 2021 Financial Health & Advice Program publishes in the U.S. and Canada on June 24, 2021. Subscribers have access to monthly pulse reports digging into this critical content area.

What happened in April (Wave 11)?

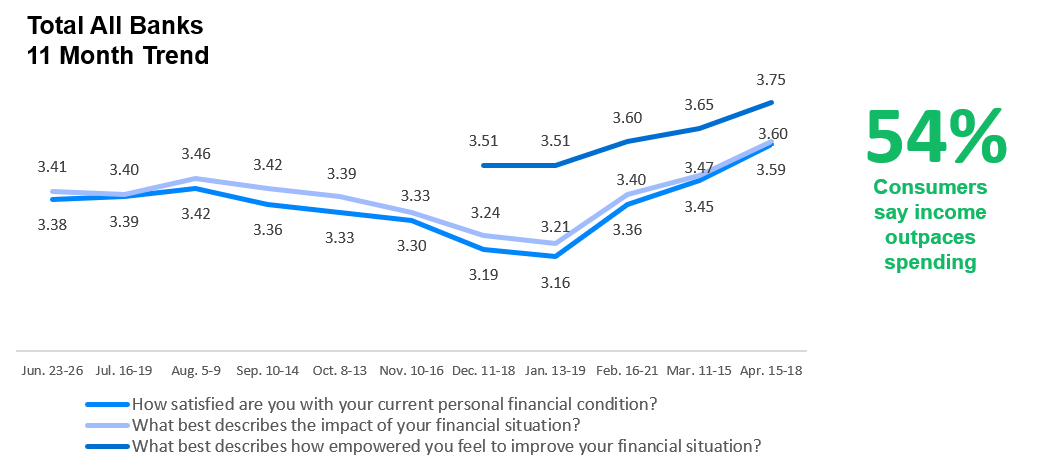

Consumer Sentiment Reaches High Point

What’s New This Wave?

Interesting Nuggets

- Regional banks have the highest proportion of consumers correctly answering literacy questions

- Consumers recognize how the Child Tax Credit for 2021 impacts their ability to save, pay down debt, and provide essentials

- 21% of bank account holders and 20% of cardholders ask that their bank/issuer help them set a budget

How Does Your App Compare?

- 60% Consumers used their banking mobile app in the last month

- 39% Changed their spending behaviors as a result of using mobile app’s features

- 51% Currently overextended consumers indicate mobile app changed their spending behavior

How Does Your Bank/Issuer Perform?

Top performers for supporting overall financial health*

|

Banks:

|

Issuers: |

|

Bank of America

Ally

Capital One

|

Bank of America

American Express

Discover

|

*Highest mean scores among J.D. Power rank-eligible brands

Questions?

Please contact your dedicated J.D. Power representative or Jennifer White (Jennifer.White@jdpa.com)

About the J.D. Power Financial Health and Advice Program

The pandemic has re-shaped how consumers think about their financial situation and goals. To help banks better understand these changing customer needs, J.D. Power conducted a series of pulse survey studies to measure consumer sentiment and provide critical insights. These pulse surveys, or J.D. Power Polaris, is the foundation for J.D. Power’s inaugural financial health and advice program.

In 2021, J.D. Power partnered with leading academic scholars in consumer finance, financial literacy and financial security as well as leading non-profits such as The Financial Health Network to introduce the J.D. Power Financial Health and Advice Program. This program is designed to closely examine today’s banking and card customers through the lens of their financial health and assess how banks and credit card providers are addressing their needs.