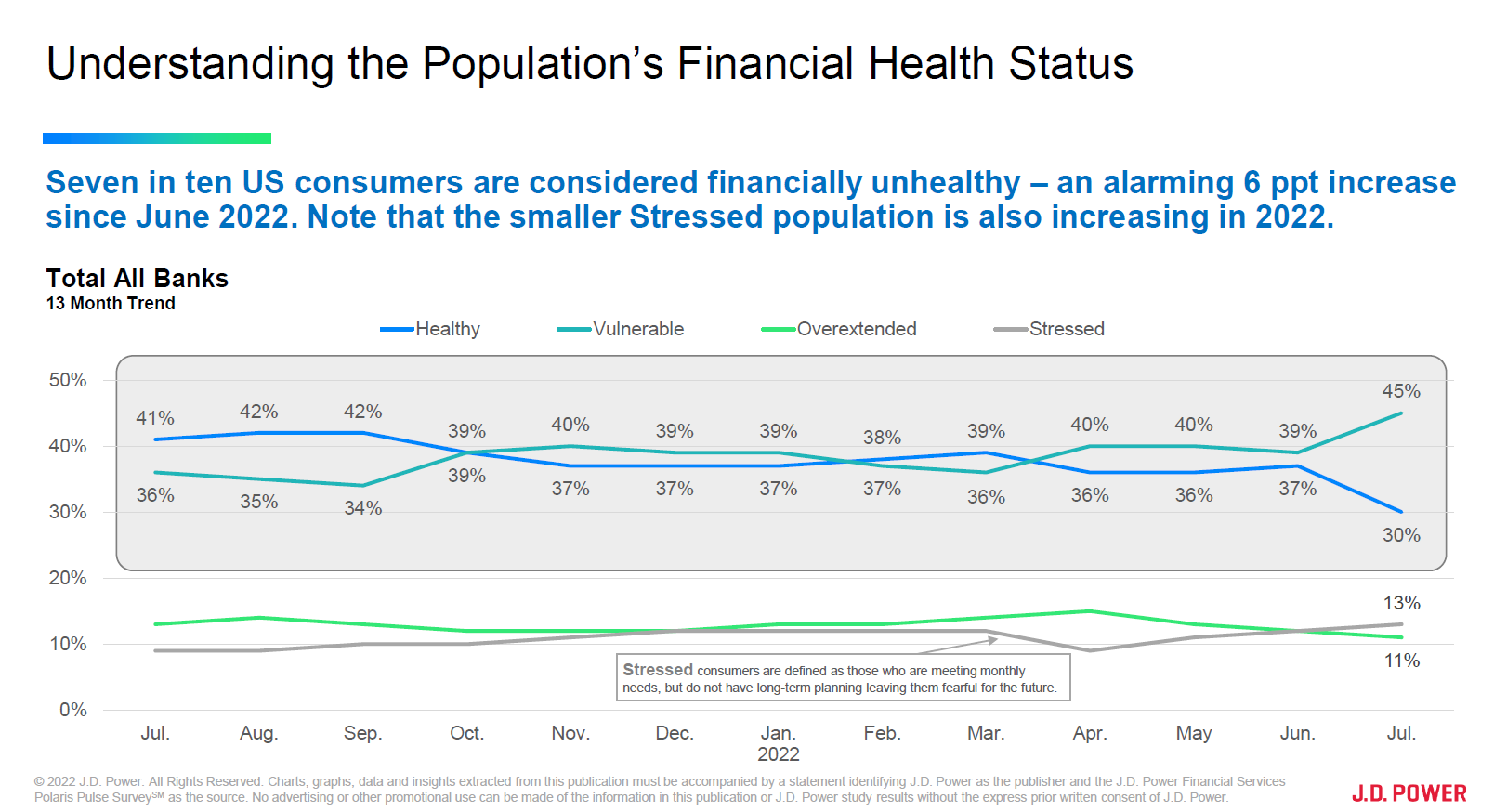

The specter of inflation has loomed over every facet of the economic landscape this year, and virtually all Americans are suffering some level of fatigue from the rising cost of goods and services. But for the first time since February 2020, when J.D. Power began tracking the financial health of American consumers, it seems inflation is finally starting to affect financial wellbeing.

According to J.D. Power data, U.S. banking customers’ overall satisfaction with their financial condition is at its lowest point in 12 months, while stress levels are mounting. In one year, the proportion of financially healthy[1] customers nationwide has plummeted, and it seems inflation is at the heart of the precipitous drop.

As inflation begins to catch up with Americans, banks are faced with a foreboding trend: Customers are exploring new ways to bridge their financial gaps, and many are either unaware of budgeting and debt assistance problems that banks offer, or they are eschewing their banks altogether in favor of private personal loans and debt management apps.

Read the Full Banking and Payments Intelligence Report >

[1] J.D. Power measures the financial health of any consumer as a metric combining their spending/savings ratio, creditworthiness, and safety net items like insurance coverage. Consumers are placed on a continuum from healthy to vulnerable.