CAT events and higher claims severity, particularly in auto, continue to put pressure on P&C insurers to manage the claims process efficiently while also maintaining high customer satisfaction.

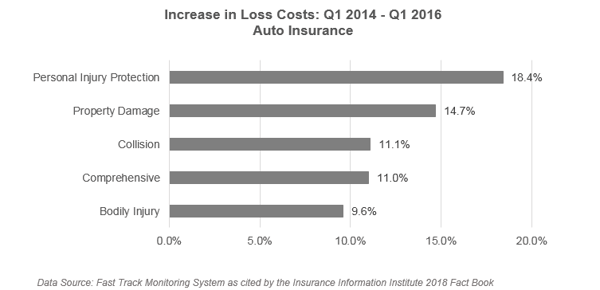

According to the Insurance Information Institute’s 2018 Fact Book, Losses Incurred for the P&C industry has continued to rise, up from $290.7B in 2015 to $318.0B in 2016; additionally, the Loss Ratio rose to 72.3% in 2016 from 69.2% in 2015. Looking particularly at personal auto claims, claim frequency and claim severity were at at 10-year highs in 2016, with 6.1% of collision policyholders incurring a claim and 2.8% of comprehensive coverage policyholders incurring a claim. Property claims were at a 5-year high in 2015 for claims severity, with one in 15 insured homes having a claim. Fast Track Monitoring System reports that all types of auto loss claims increased from Q1 2014 to Q1 2016 by nearly double digits across the board.

With claim severity and costs on the rise, particularly because of claim frequency and the number of technologies now included in vehicles as well as smart technologies used in properties, insurers need to continue to push the needle on servicing claims. Thus far they have been doing a relatively good job, evidenced by findings in the J.D. Power 2018 U.S. Property Claims Satisfaction StudySM (PCS) and the J.D. Power 2017 U.S. Auto Claims Satisfaction StudySM (ACS): the insurance industry reached an all-time high customer satisfaction score in the 2018 PCS study, 860 points (on a 1,000-point scale), with auto claims not far behind, at 858 points, in the 2017 ACS Study.

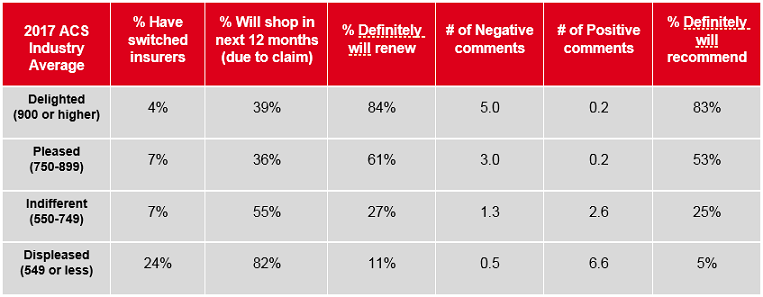

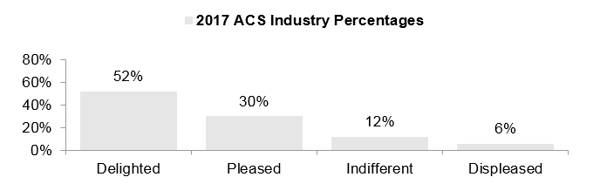

Claims are a key moment of truth in the relationship between an insured and their insurer. In both the ACS and PCS studies, providing a highly satisfying claims experience is shown to lead to better financial outcomes for the insurer. Insureds who are Delighted with their claim experience (satisfaction scores of 900 or higher) are less likely to switch insurers, less likely to shop for a new policy, and much more likely to provide positive recommendations for their carrier, as evidenced by the below ACS Study graph. The same trend is shown for data from the 2018 PCS Study.

Source: J.D. Power 2017 U.S. Auto Claims Satisfaction StudySM

Source: J.D. Power 2017 U.S. Auto Claims Satisfaction StudySM

Source: J.D. Power 2017 U.S. Auto Claims Satisfaction StudySM

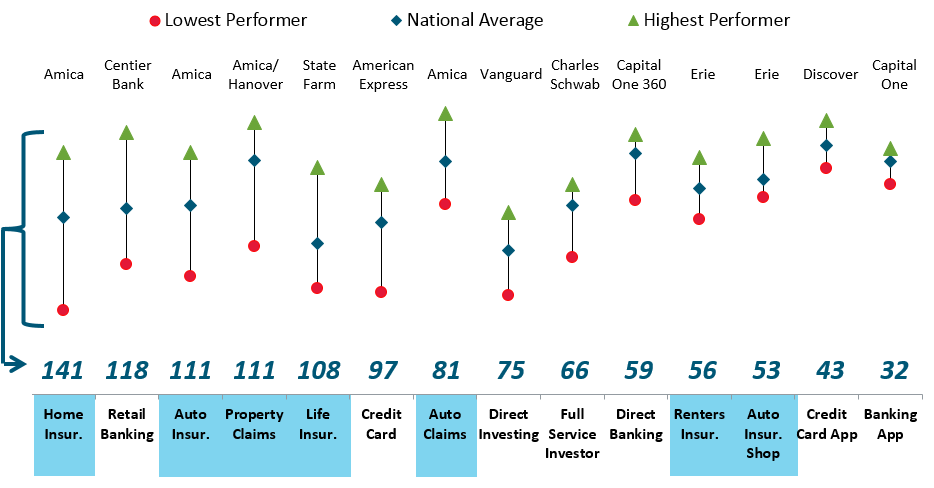

As evidenced in the following graph, customer satisfaction is becoming increasingly less differentiated in the Insurance and Financial Services industries, making it crucial for companies to differentiate with customers in these highly competitive markets. The spread of customer satisfaction performance from the highest to lowest performer in the PCS is 111 Index points and only 81 Index points in the ACS.

Overall Satisfaction – Brand Performance Spread

Sources: 2017 J.D. Power Financial Services and Insurance Studies, brand listed at top is highest ranked in study

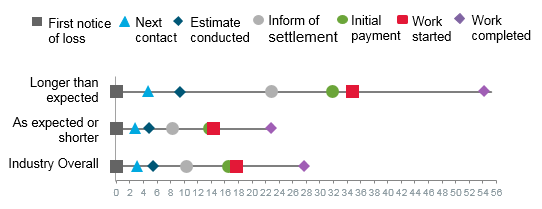

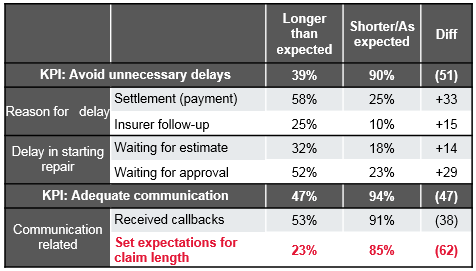

How can a P&C insurer differentiate in the claims process and continue to take market share and increase overall profitability? J.D. Power has identified that high-performing insurers distinguish and set themselves apart from their competitors during a claim by focusing on 1) managing and meeting customer expectations of the claim duration; 2) providing clear and appropriate communication throughout the claim in the customer’s preferred channel; 3) meeting settlement expectations; and 4) having operational benchmarks and internal standards in place and integrated throughout the company and third-party vendors. For example, in the 2018 PCS, overall satisfaction declined by 62 index points when insurers set a customer expectation for length of a property claim and then missed that mark. Also, according to the 2018 PCS, this occurred 23% of the time industry wide. This same trend held true in the 2017 ACS, in which insurers missed their promised timeline 30% of the time, which caused overall satisfaction to decline by 182 index points. Certainly, insurers missing the promised timeline results in a dissatisfying experience and causes customers to consider switching brands or provide negative recommendations.

Expectations of Claim Timing by Cycle Time

Source: J.D. Power 2018 U.S. Property Claims Satisfaction StudySM

Source: J.D. Power 2018 U.S. Property Claims Satisfaction StudySM

Drivers of Missed Expectations of Claim Timing

Source: J.D. Power 2018 U.S. Property Claims Satisfaction StudySM

Source: J.D. Power 2018 U.S. Property Claims Satisfaction StudySM

In an industry with increasing pressure on financial ratios and performance, insurers must balance innovating their technologies and claims operational processes to refine both underwriting and claims management, as well as provide a satisfactory experience to their customers. A failure in either area leads to direct and indirect financial consequences for the insurer. It is crucial for insurers to understand the Key Performance Indicators (KPIs) that drive customer satisfaction and loyalty, as well as the key operational benchmarks that high-performing claims operations focus and deliver on. These brands will achieve excellence in the eyes of their customers, potential customers, and the vendors they work with as well as improving operational and financial performance.