The following is the second excerpt from our upcoming post “Are personalized auto insurance rates driving shopping behaviors?” Read the first excerpt here.

In the first part of this series we explored customer understanding of auto rate setting factors. What we find is that customer awareness and expectations of rate setting factors is low. That low awareness is often driving carriers to a wrong conclusion. In focus groups and surveys, customers claim they want a personalized auto insurance rate, but because they do not understand what goes into building a personalized rate, this isn’t really what they have in mind. The lack of agreement on what personalization means combined with a siloed execution approach is driving marketing, distribution and underwriting departments to create a divergent customer experience that reduces satisfaction and increases shopping.

When we analyze several years of customer behavior, we see three tactics that carriers can employ that deliver a personalized experience while minimizing the impact of shopping behaviors initiated by rate changes. The most impactful tactics we observe are to:

- Align customer expectations to underwriting philosophy (or vice versa)

- Ensure customer communications are aligned with expectations

- Enable a higher level of customer control

In this second part of the series, we examine ways in which carriers can deploy the first tactic and align customer expectations with their underwriting philosophy (or vice versa).

Customer expectations are driven by brand and marketing messages. Rates will inevitably change over time, but how and when they change is a strategic decision that needs to align with the brand promise.

We identify two basic types of customer-carrier relationship messages: 1) long-term, client service; and 2) consumerist, product acquisition. Long-term relationships are built on personal interactions, predictability and stability (e.g. service). Consumerist, product relationships are built on price, ease and convenience (e.g. product). Many carriers reference one or the other but sometimes both, potentially setting inconsistent expectations.

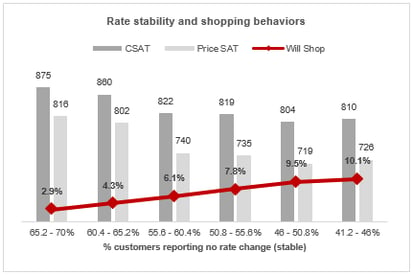

For carriers that set relationship expectations of long-term, client service, rate setting philosophies need to reflect this level of required stability. Having a clear understanding of overall AND price satisfaction is a good way to gauge the value a customer is experiencing. Carriers with more stable rates tend to exhibit less differential between overall and price satisfaction and have customers that are 1.6x less likely to shop. Continual monitoring of the gap between overall and price satisfaction is critical, especially if rates change. The further it diverges, the more likely shopping and switching will occur.

For carriers that set relationship expectations of long-term, client service, rate setting philosophies need to reflect this level of required stability. Having a clear understanding of overall AND price satisfaction is a good way to gauge the value a customer is experiencing. Carriers with more stable rates tend to exhibit less differential between overall and price satisfaction and have customers that are 1.6x less likely to shop. Continual monitoring of the gap between overall and price satisfaction is critical, especially if rates change. The further it diverges, the more likely shopping and switching will occur.

In a more consumerist, product acquisition relationship, the expectation becomes more centered on the lowest rate. Achieving low rates usually implies rate setting precision that leaves little room for market fluctuation. If large portions of a book are experiencing frequent rate changes due to changing market conditions (e.g. frequency, severity, healthcare, etc.) shopping can increase by a multiple of almost 4x. To pursue a product acquisition focused strategy a carrier needs to either: 1) have an acquisition cost that supports higher levels of churn; or 2) be extremely precise in selecting which customers to allocate rate increases. This requires not only a detailed understanding of how to rate each customer, but also their state of overall and price satisfaction, price satisfaction elasticity and acquisition segment expectations. Product-oriented carriers should always know whether the value of customer loyalty will outweigh the price increase and allocate accordingly.

Aligning brand message with relationship expectations is a particular challenge for the insurance industry. Very few other products have prices that can change so frequently, and from the customers point of view, so opaquely. Frequently fluctuating rates can confuse customers and cause them to seek a more stable relationship or just shop for the next best low price. It also drives the focus on only the price. While this is a key component of a consumerist strategy, practiced for too long or across too many customers and the ability to message anything beyond price during the ownership cycle can be lost.

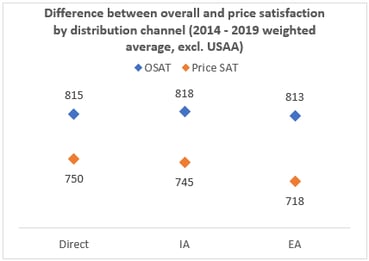

Distribution channel, an extension of any marketing arm, also carries a brand message. When we look at the overall / price satisfaction spread by distribution model, the agent channel has the highest spread. It is reasonably common for agent-based carriers to message long-term, client-like relationships. However, the messages or services delivered by the agent do not appear to be aligning with broader corporate messaging and / or rate actions. Agent-based carriers tend to have higher price points, and customers are already struggling to see the value of the exclusive agent service before a rate change. When rates change frequently in the agent channel, Price Satisfaction falls more than for any other channel. Satisfaction elasticity is more fragile in the agent channel and drives shopping.

Distribution channel, an extension of any marketing arm, also carries a brand message. When we look at the overall / price satisfaction spread by distribution model, the agent channel has the highest spread. It is reasonably common for agent-based carriers to message long-term, client-like relationships. However, the messages or services delivered by the agent do not appear to be aligning with broader corporate messaging and / or rate actions. Agent-based carriers tend to have higher price points, and customers are already struggling to see the value of the exclusive agent service before a rate change. When rates change frequently in the agent channel, Price Satisfaction falls more than for any other channel. Satisfaction elasticity is more fragile in the agent channel and drives shopping.

Relentless focus on the brand perception and its underlying meaning to customers is key to maintaining a message that is consistent with rate actions. Expectations that aren’t aligned with frequency and allocation of rate actions result in falling satisfaction and shopping. If multiple messages are going to be delivered, they need to fall under an applicable brand portfolio to remain consistent.

The key strategic questions to answer are:

- Which message are you delivering?

- Does that message align with the brand perception?

- How is that impacting customer expectations?

When these questions are understood in detail, a carrier can begin to have a conversation across silos that aligns core underwriting philosophy, measures frequency and instance of rate changes and assesses the impact of distribution on shopping and retention.

Stay tuned for our next post where we explore tactic two: ensuring customers communications are aligned with expectations.