The following is an excerpt from our upcoming post “Are personalized auto insurance rates driving shopping behaviors?”

Rate setting in auto insurance has become a data-driven, technical process. An almost unlimited number of factors can be used in risk and scoring models to reflect each customers unique and characteristic rate. Modern computing, data acquisition and analytic tools can determine this rate in mere seconds. This capability will only grow more powerful as Artificial Intelligence and Machine Learning models become more integrated into underwriting systems. On the surface this seems to align with what the customer wants, but dig deeper, and it isn’t so clear. They don’t understand how a rate is derived in enough detail to appreciate the impact that personalized rates have on their own satisfaction or their relationship with carriers.

Auto insurance rates are derived from two main components—market risk and individual risk. Market risk reflects the aggregate number of accidents (frequency), the cost of repairing vehicles (severity), caring for injuries and other factors. This is a volatile, difficult to observe (for a customer) value that changes daily. Individual risk is a subset of these characteristics as well as personal situations—type and number of vehicles, coverage, life events, etc. This is a more stable and, from the customer’s perspective, controllable value. Customers understand the latter acutely, but not the former. In fact, they not only don’t understand market risk, but they don’t believe that it applies to their rate. After all, they can easily see and understand the impact of their own actions, but their vehicle doesn’t cost more to repair. They haven’t had an accident. Their frequency isn’t changing.

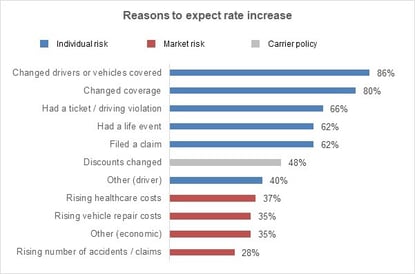

When rate setting factors are broken into components, customers don’t expect market risk factors to apply to personalization. Roughly a third or fewer customers expect their rate to be impacted by market risk. This stands in stark difference to the more than half that expect their own actions or life circumstances to impact their rate. When we consider that a large amount of risk pricing is driven by frequency, repair severity, BI cost, legal adjudication, etc. it becomes apparent that personalized pricing is in direct conflict with customers’ expectations of how their rate is determined.

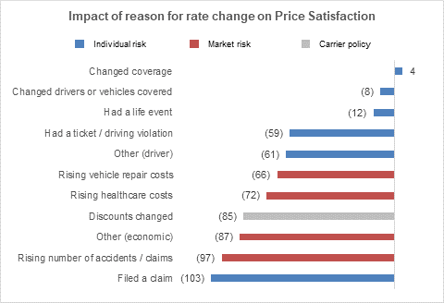

Further exacerbating this problem, customers’ reactions to rate changes are directly linked to which components cause the change. Price satisfaction falls precipitously when market risk factors are at play. When satisfaction falls, the propensity to shop and potentially switch increases dramatically. Sure, they aren’t happy when rates change after filing a claim, but at least they expect it to happen.

This is a real problem for carriers today—Price satisfaction is already low across the industry. Auto insurance inflation has outpaced CPI by more than a factor of 2x over the past decade leading to growing levels of shopping and switching that increases already strained acquisition costs. When we look at the factors impacting rates today and into the near future, these disconnects are only likely to grow. Distracted driving, expensive to repair automated and electric vehicles and ever-rising healthcare costs will almost ensure that market risk continues to drive rate increases above inflation.

Herein lies a significant strategic challenge: underwriters can set rates with daily personalized accuracy, but customers don’t like rate volatility. Left unresolved, carriers can expect shopping to continue to grow and policy life expectancy to shrink. Resolving this challenge demands carriers ensure their messages align with customers’ expectations of the product or service they will receive. Internal silos—from marketing to underwriting to distribution—need to align on a common end-to-end strategy and coordinate customer communications across operations to increase customer understanding.

Stay tuned for our full post where we explore three effective tactics that carriers can use that deliver a personalized experience to minimize the impact of shopping with rate changes.