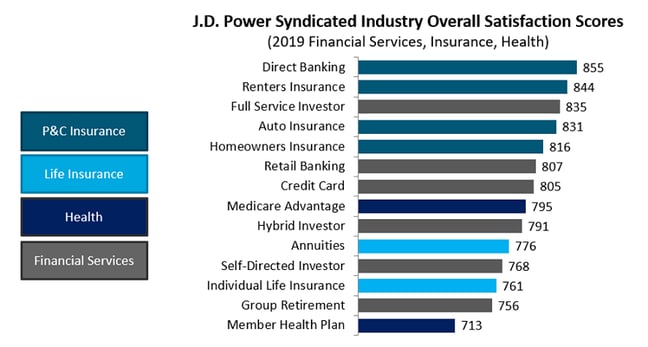

The Life Insurance and Annuities industries have some catching up to do in putting the customer at the center of their experiences. Relative to other financial services and insurance products that have focused on the end consumer for many years, both Life insurance and Annuities are significantly behind in customer satisfaction with the product and experience. The industry may be at an inflection point in how they think about the customer — the end-customer that is. For many years, the “customer” has been perceived as the producer which has largely left the end-customer experience to suffer.

Understanding of the product itself makes up a great deal of the customer experience — particularly when there are few reasons to interact with customer service or your advisor. The Product Offerings factor is in fact the largest weighted factor of the overall customer satisfaction score which is determined by how customers respond to the various questions in the study. This is a bit unique across the industries J.D. Power measures in the Global Business Intelligence sector. Typically, customer interactions with their brand are the most significant driver of their overall customer experience; however, given life insurance and annuities, by nature, are lower touch than many other products and services, the product itself and the cost become significantly more important to customers.

Perhaps a result of a less than optimal focus on the end customer, communicating the value of the product for the price that is paid, has largely been missed. Customers need ongoing validation of the value they get for what they pay. The traditional focus on the sales process alone has largely neglected customers’ real need to be reminded of the value proposition throughout the course of the relationship. The general trend for customer satisfaction in Life Insurance is that satisfaction declines from the moment a customer purchases the product/policy. That dynamic in customer satisfaction among Life Products is vastly different from other services industries where satisfaction is highest among higher tenured customers.

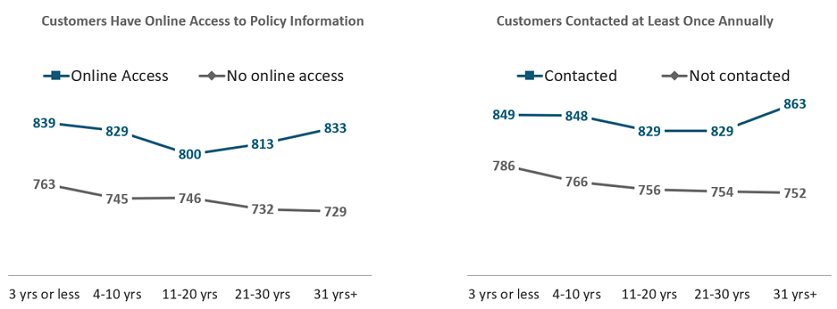

However, there are Key Performance Indicators (KPIs) identified by the J.D. Power Life Insurance Studies that re-align the customer satisfaction to tenure trend with other financial and insurance products and services. The first of which is online access to information. Customers who have online access are generally more engaged which provides the opportunity to better understand their product though published content but also the breadth of products and services that can be available to them should their needs change or expand. The second KPI is to contact customers at least once annually to remind them of the value [Product factor] they get for what they pay [Price factor]. Such contacts can be as simple as a helpful brochure outside of a typical statement or any other normal course of business communication.

Key findings from those critical factors of the customer experience:

- Satisfaction with the Product Offerings: When we ask customers about the product offerings there are two themes that emerge. First, how well do they understand their product and what does the company do to either provide them the tools and information to understand or are advisors taking an active role throughout the relationship to ensure the product continues to meet their needs. Second, is understanding how the product works for them over time or can be tailored to their individual needs as they change over time.

- Satisfaction with Price: Customers satisfaction with the price they pay, after purchase, is all about the price to value equation that surfaces every time they think about the company they do business with. Given there are few touchpoints for Life and Annuity customers, every interaction, every statement, every brand mention can be a moment of truth for current customers — in other words, a variable in the price to value equation. Executing the best practices related to customers understanding what they get for what they pay are the most effective ways to tip the price to value equation in the right direction — for both the customer and the company.