The recent gains in the global financial markets have reinvigorated insurer investment return hopes and, thus, the importance of a well-structured and disciplined investment strategy for industry executives.

During this growth cycle, well-capitalized companies are garnering a major strategic advantage over their peers due to their capital structure. This will have an impact on short-term profitability and shareholder equity, and create a boon for their customers, bringing greater rate stability, operational improvements, and, ultimately, higher levels of customer satisfaction.

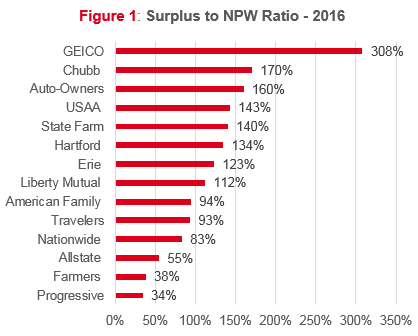

For insurers with a strong capital position, this period of economic growth presents an immense opportunity. The companies that stand to benefit the most are those with superior surplus-to-NPW ratios (Figure 11), as they are better able to put their money to work and withstand the downside of higher investment risks. For example, companies such as GEICO (308%) are positioned to chase higher investment returns, compared with such companies as Progressive (34%), whose limited surplus levels requires them to take a more conservative investment strategy through shorter-term duration and lower-risk investments.

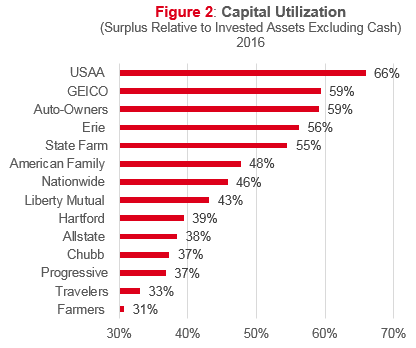

Top performers that are using higher percentages of their surplus for investments (Figure 22) are creating even greater capital separation through higher investment returns in what has become a capital “arms race.” That is to say, companies with already strong surplus levels are able to grow their surplus at a greater rate through higher yields than those with lower surplus levels— extending their competitive advantage even further.

The stakes could not be higher, as operational improvements that deliver higher customer satisfaction are paramount in a fiercely competitive marketplace where carriers are struggling to attract and retain customers.

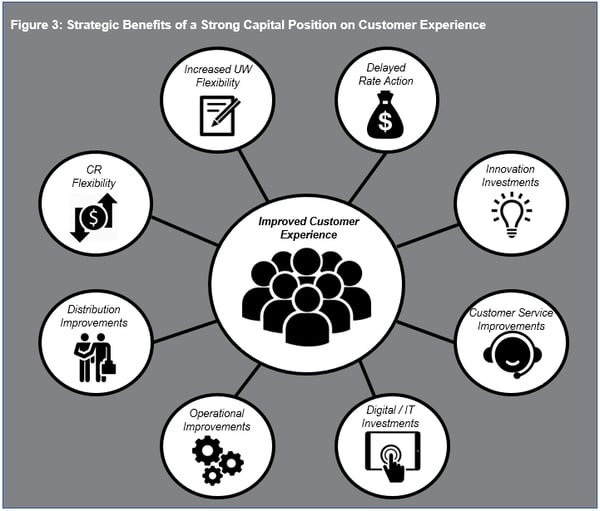

The capital separation generated by higher yield investments also translates into operational advantages that lead to higher customer satisfaction. Top-performing carriers can reinvest those earnings into the customer experience through increased underwriting flexibility, greater rate stability, customer service enhancements, or other operational improvements (Figure 33).

Conversely, companies with more constraints due to lower surplus levels will need to make hard choices about whether to invest in securities, operations, or customers. Investments in securities to capture the opportunity arising from an improving economy must now be weighed against operational investments to improve customer satisfaction that can drive core business growth—where increased acquisition and retention gains fuel future investment opportunities. This trade-off involves hard choices about where to focus, where to cut back, and how to capture the opportunity arising from a booming economy.

As a backdrop to these developments, P&C companies must ensure they follow a clear and proven investment strategy to avoid drifting into random speculation or being lured into promises of higher yields without understanding the risks.

While the risk profiles and capital constraints vary widely across the industry, each carrier can review its own overall investment framework to achieve superior risk-adjusted investment returns, such as:

- Improve Effectiveness—What improvements can be made to your investment strategy, organization, and asset allocation to improve returns without impacting risk levels?

- Take More Preferred Risk—Where would you be willing to assume more risk to achieve improved returns?

- Outperform the Market (Alpha)— Where can you outperform the market through the utility of skills, insights, and capabilities?

The global markets are now rewarding carriers able to take advantage of this period of economic growth. Due to the scale of investments in an insurance company’s balance sheet and the impact of investment results on the customer experience, the management of these investments is a key function that will create a significant strategic advantage for carriers that are able to capitalize.

1Source: SNL Financial, J.D. Power Analysis

2Source: SNL Financial, J.D. Power Analysis

3Source: J.D. Power Analysis