One of the oldest axioms in business says that if you take care of your customers they will take care of you. Despite the truth and intuitive feel of this axiom, it also raises the logical next question in the minds of industry executives, at what cost?

That is the difficult issue with which businesses must grapple. What is the right level to go to in pursuit of customer satisfaction? When does the pursuit of greater satisfaction stop paying off and in which areas of your interactions with customers does it pay off the most?

The proper balance of effort and benefit related to customer satisfaction is hard to determine for most businesses, but especially for those that are based on service, such as the insurance industry. In fact, it is more difficult for insurers than for other service industries because insurance is necessitated by the potential of negative events in a customer’s life. Insurance, by its very nature, has its relationship with customers beginning on a negative note. Despite this, or maybe due to it, there is a strong link between quality customer service and financial success for insurers. Yet, many insurers do not know how to maximize the return they get on their investment in customer service. Some insurers do not have a clear understanding of what drives customer satisfaction, where they stand relative to competitors in customer service delivery, and how their customer satisfaction performance has changed over time or even how customer satisfaction relates to their financial results. Measuring these customer satisfaction items in concert with financial results gives insurers the tools needed to enhance the return they get on their investments in customer service delivery.

Customer Satisfaction Linked to Insurer Financial Benefit

Although it is intuitive that high customer satisfaction should result in better business results, it is still good to have hard evidence. J.D. Power has tracked insurance customer satisfaction for a long time and in many aspects of customer interaction with insurers. Recently, J.D. Power teamed with several renowned universities1 to conduct more detailed examinations of the company’s data to identify insights and findings that would be useful to the insurance industry but that had not previously been reported. In those examinations, J.D. Power provided the data it collected over several years and allowed the academic teams to conduct their own research, without direction or input from J.D. Power.

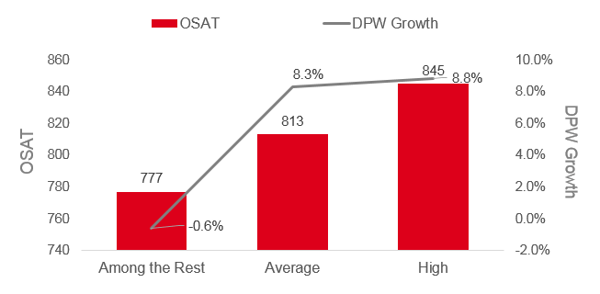

One team’s research established a strong connection between customer satisfaction and insurer financial performance. In other words, those insurers with more satisfied customers made more profit.

Customer Satisfaction and Growth:

U.S. Auto Insurers from 2001-2015

Source: St. John’s University and J.D. Power research of Overall Customer Satisfaction and the Combined Ratios of U.S. Auto Insurers from 2001-2015 using a multivariate linear regression analysis

Source: St. John’s University and J.D. Power research of Overall Customer Satisfaction and the Combined Ratios of U.S. Auto Insurers from 2001-2015 using a multivariate linear regression analysis

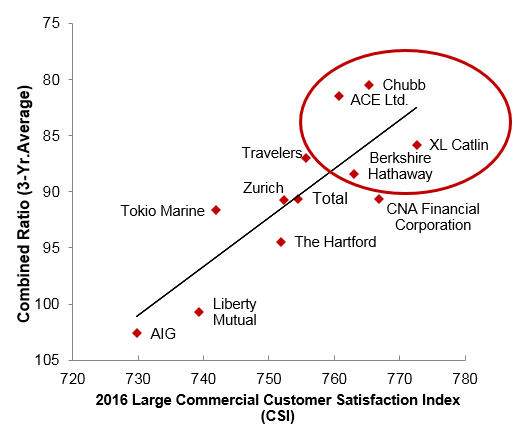

In its own analyses, J.D. Power has identified a similar relationship to that found by St. John’s between customer satisfaction and financial performance by comparing individual insurance company customer satisfaction scores over time with their Combined and other Operating Ratios. Additionally, J.D. Power has identified the interactions insurers have with their customers that most affect satisfaction as well as the drivers of that satisfaction. Although the specifics vary by industry segment (e.g., P&C, life, and health) and by interaction type (e.g., shopping, servicing, and claims), several common themes have emerged, such as the frequency, clarity, relevance, and mode of communication with customers regarding such items as timing expectations, status updates, and change explanations—all of which are prominent drivers of satisfaction. Further, items impacting customer satisfaction unique to industry segment and type of interaction, among others, have also been identified and measured.

Example: Total Commercial 3-Year Avg. Combined Ratio and

Large Commercial Satisfaction

Knowing that customer satisfaction leads to financial benefits for insurers makes knowing the details of which services and actions most and least impact satisfaction valuable.

Negative Interaction Bias

Being designed to address situations that purchasers hope won’t happen, the very nature of insurance taints all interactions with customers and potential customers from the start. This is not a surprise to anyone in the industry, but the effect of this overlay of a negative event orientation on the various interactions and the choices of how to conduct those interactions is not always obvious. Furthermore, the degree to which these interactions impact financial performance is not clear for most insurance executives, yet they are needed in order to determine the best way to overcome the negative bias and to outperform competitors while adding value to their company.

Knowing more about the relationship between customer satisfaction and financial performance allows a company to know how best to invest resources and time to achieve the best balance between them. It also informs management about how best to outweigh the “negative event” bias that is interwoven into almost all customer interactions and provides clarity on the value of doing so. Although providing exceptional customer service is always the goal for insurers, sometimes there can be too much of a good thing. There are times when chasing improved customer service can be too costly for the benefit received. Unfortunately, it is difficult to determine where the break point of investments in customer service is without the right information with which to measure the relationship between the two.

Know How You Perform

Bringing a deeper understanding to insurance executives about the relationship between customer satisfaction and insurer financial performance—including the drivers of satisfaction and the degree to which each drives satisfaction—equips them with the tools needed to properly prioritize and improve customer service activities and the benefits they produce. Having measures in place that relate customer interactions with insurer functions and activities is critical to refining service delivery quality and appropriateness. Trending customer satisfaction performance with insurer investments in people, process, and technology is critical to identify and maximize returns. Executives need to have confidence that their business functions are producing the desired effect on customer satisfaction and financial results. This includes identifying when additional investment in customer service is and is not needed.

The link between customer satisfaction and financial results should be the basis for insurer investment or disinvestment in customer services. Specific business cases should leverage the measures of customer satisfaction and their drivers with a knowledge of where the insurer is positioned relative to competitors in both customer satisfaction and financial results. With an understanding of how much can be gained relative to current performance and competitor performance, in addition to the financial benefits that will likely result, management can make more prudent decisions on the commitment of resources to customer service with greater certainty.

1University of California, Los Angeles; St. John's University; and University of South Carolina