Small business owners are increasingly seeking fast and simple digital solutions for their insurance needs. According to findings from the J.D. Power 2019 U.S. Small Commercial Insurance Study,SM digital channels are more influential than ever before in shaping small commercial customer experiences with insurance companies.

All-Time High Satisfaction

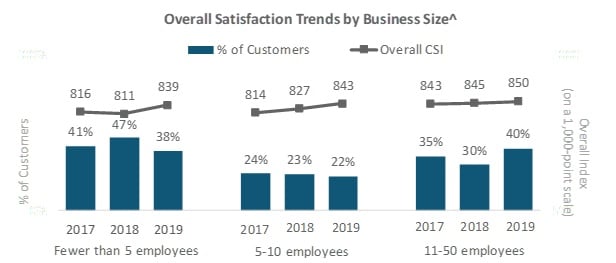

Customer satisfaction has reached an all-time high in 2019. The overall Customer Satisfaction Index (CSI) has increased by 19 index points year over year to 844 (on a 1,000-point scale). While this marks the first significant increase in satisfaction over the past three years, overall CSI has increased by a staggering 67 points since 2013—the year the study was launched. Insurers have notably improved satisfaction among micro-sized businesses (fewer than five employees) in 2019, which is a segment of customers that has been previously underserved by insurers.

^Note : Due to the inclusion of new profiled insurers in 2019 year-over-year comparisons of the proportion of business size in the study may be impacted.

Omnichannel with Digital Drives CSI

Price is a key contributor that separates omnichannel with digital interactions from offline interactions. Customers who use offline and digital channels are more likely to understand the reasons for price changes and to connect price to value by having a greater understanding of coverages. Claims, specifically procedures and policies, also contributes to the gap.

Digital Makes it Easy and Transparent

Customers that have access to and/or use digital touch points—such as accessing policy information online (73% of customers) and receiving emails from insurers for risk management information (48% of customers)—are more likely to receive notifications regarding price changes and discuss options to mitigate price increases vs. those who do not have or use them. Increasing the adoption of these digital touch points, especially among micro businesses and Boomer customers who are less likely to say they have online access and use email for risk management, may help to improve transparency around their rate changes.

Self-Service Digital Options are a Key Component of Omnichannel

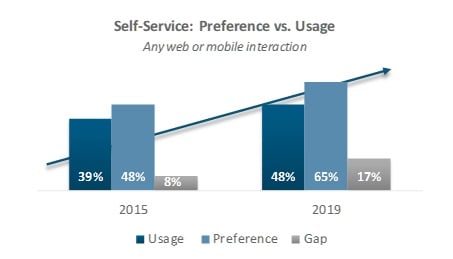

Website and mobile self-service channels are two primary digital channels that are increasingly becoming requirements for meeting customer expectations. Customer preference and usage of self-service have grown since 2015. Preference growth rates have been fueled by larger-sized businesses (47%), while usage growth rates have been fueled by micro businesses (28%).

The preference for self-service, however, has rapidly outpaced actual usage. The gap between preference vs. usage has widened across business sizes from 2015 to 2019, indicating an even greater need for self-servicing options in the small commercial market.

Traditional agents are potentially losing ground to digital, driven by customers increasingly preferring insurer websites for complex tasks. The gap between web vs. agent preference has narrowed since 2017 for tasks that are more complex, such as: price changes, policy changes, and renewing/purchasing.

As insurers continue to invest in the small commercial market, it will be important to understand the impact of digital on small customer experience and to continue developing digital capabilities and expertise to meet customer demand. For more information on these topics from the 2019 U.S. Small Commercial Insurance Study, please check out our study overview or request to be contacted with additional details.