Consumers have greater access to information today about products, services, and the brands they choose to do business with than they ever have in the past. This increase, while having an overwhelmingly positive impact on the customer experience, can lead to challenges for some in capturing new business and retaining current customers.

The reputation of a brand in the marketplace is critical for having an efficient purchase funnel (i.e., not losing too many customers in the purchase process); however, reputation is also critical with respect to retention and the brands ability to stay in the consideration set for additional business. The good news is, most customers rate their brand’s image on various attributes higher than other brands in the marketplace. That said, there is much to be learned by pinpointing areas in which customers would prefer other brands based on their reputation.

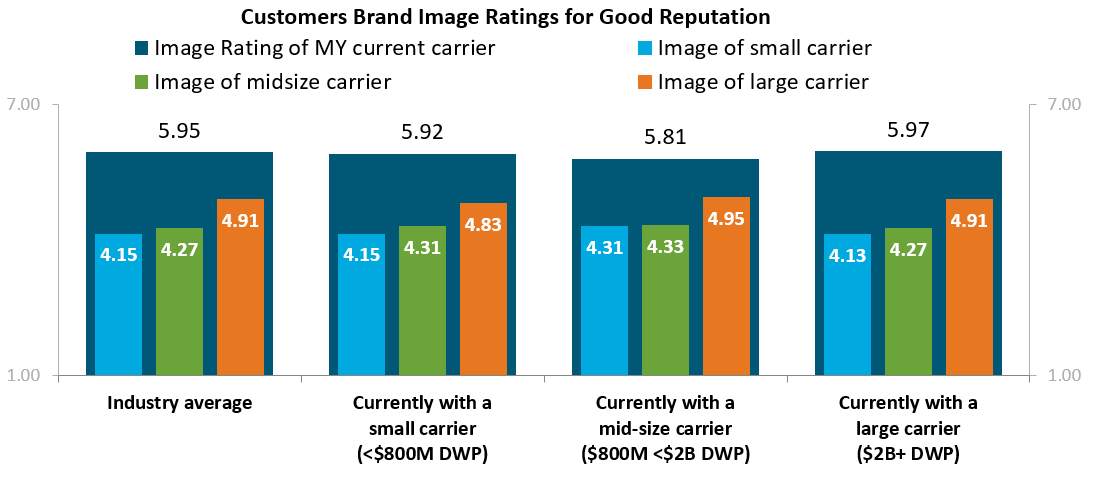

In P&C Insurance, customers tend to rate brands, other than their own, based on their familiarity with the brand, national recognition, and messaging in the marketplace. To that end, it is no surprise to find Large brands with over $2 Billion in Direct Premiums Written (DPW) are rated higher among non-customers than Medium and Small brands with $800M to <$2B in DPW and <$800M in DPW, respectively. Again, while customers rate their current brand higher than most prospect brands, large National brands, with national marketing campaigns, clearly have an edge if or when that customer gets one too many premium increases, has one unforced error, or has a less than optimal claims experience.

Source: J.D. Power 2018 U.S. Auto Insurance Study

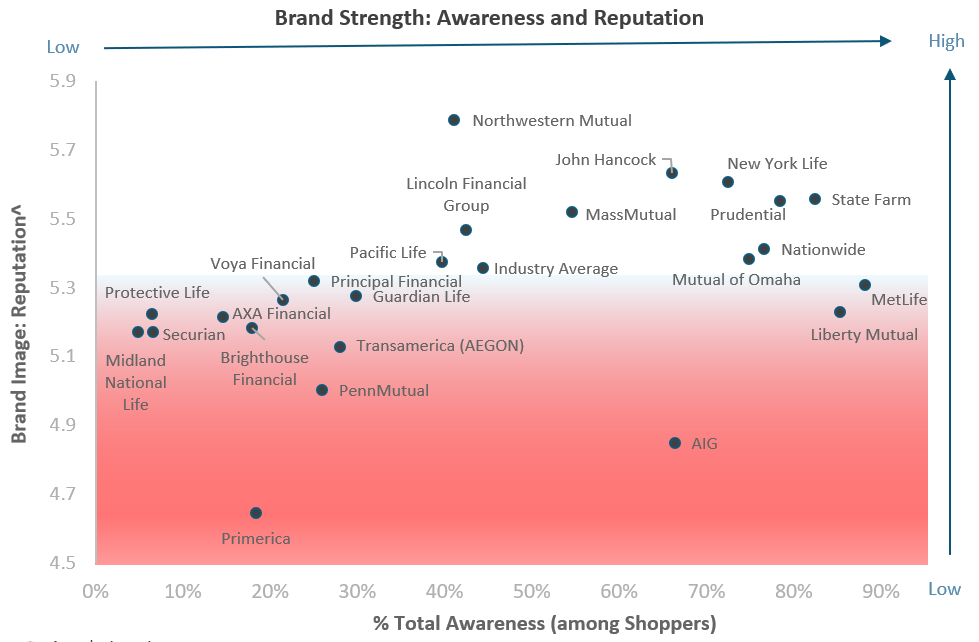

In Life Insurance, Individual Life and Annuities providers are battling an even more pronounced two-tiered challenge with the brand: Awareness and Image. Awareness and Image lead to vastly different opportunities among brands with respect to improving the efficiency of their purchase funnel, and the brands that excel in both Brand Image (reputation among prospects and customers) and Brand Awareness (among prospects) have the greatest yield of new business. It’s a simple concept — brands with high awareness but low close rate (non-efficient purchase funnel) can result in the same or even lower yield of new business than a brand with very low awareness but a high close rate (highly efficient purchase funnel). As an example, many P&C brands selling Life and Annuities have high awareness of the brand as a result of customers recognition of the brand as Insurance. Many of the traditional life insurance, retirement, and annuity brands have significantly lower awareness but high close rates because those aware of that brand tend to already have them in their consideration set, may be more serious shoppers, or have unique needs that brand can accommodate.

Source: J.D. Power 2019 U.S. Life Insurance Study

With respect to brand image, Life and Annuity providers also find themselves behind many other industries which tends to be a symptom of one, or a combination, of three sources: disconnect between advisor-client relationship and brand-client relationship; fewer opportunities to reiterate value as a result of low customer engagement; and minimal top of mind recall of brand messaging relative to other consumer brands. As a result, providers experience new or enhanced challenges in the customer experience. First, few customers have a deep trust for their life insurance and/or annuity provider. Second, customers are less likely to understand how the brand meets their needs today and, perhaps more importantly, how the brand can meet their future needs. And lastly, customers are highly unlikely to recommend the brand to family, friends, colleagues, etc. which is a critical element in a highly referral-driven business.

Source: J.D. Power 2019 U.S. Life Insurance Study

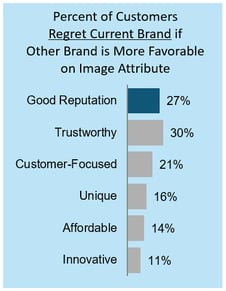

If customers found a competing brand to have a greater overall reputation, 27% regretted their decision to purchase with their current brand. For the Insurance Industry, specifically Life Insurance in the example provided, 30% of customers that felt another brand they were already aware of was more trustworthy, regretted purchasing their current life insurance policy.

In addition to a customer’s experience with your brand, it is important to understand the relationship between customer experience and brand image and how brand image influences current customers satisfaction with their experience, particularly in low-touch industries. How does image influence prospective customers in the purchase funnel? Conversely, it is important to also understand how the customer experience influences current customers’ views of the reputation of the brand and in turn their likelihood to increase investment or recommend the brand to friends and family. At the end of the day, if they view their current brand as being deficient relative to another brand, they are highly likely to regret their current provider – a rare occurrence, yet detrimental to any book of business with a sizable group of regretful customers.