The insurance industry needs dynamic auto pricing symbols.

At last month's Casualty Actuarial Society’s (CAS) Ratemaking, Product & Modeling (RPM) seminar in New Orleans, I had the opportunity to join Martin Ellingsworth from Salt Creek Analytics and Liam McGrath and Clayton Spinner from WTW for a panel discussion around how insurance carriers can simplify their risk analysis using VIN-specific, as-built data.

At last month's Casualty Actuarial Society’s (CAS) Ratemaking, Product & Modeling (RPM) seminar in New Orleans, I had the opportunity to join Martin Ellingsworth from Salt Creek Analytics and Liam McGrath and Clayton Spinner from WTW for a panel discussion around how insurance carriers can simplify their risk analysis using VIN-specific, as-built data.

VIN level data has been used in ratemaking for decades. As vehicles get less homogeneous at the make and model level, there is more opportunity to add precision to rating not just using the first 8 digits of the VIN, but the entire 17-digit VIN. Our session dove into the ways auto insurers look at vehicle data and confronted some of the challenges associated with using a one-size-fits-all approach. We also explored examples using insurance loss data to show how using changes in used car prices can enhance pricing algorithms.

For those who were unable to catch our panel, below is a recap of our discussion.

Martin cautioned insurers to be ready to explain why the same base rate increases were being applied across the board despite every car having different safety features and a different actual cash value.

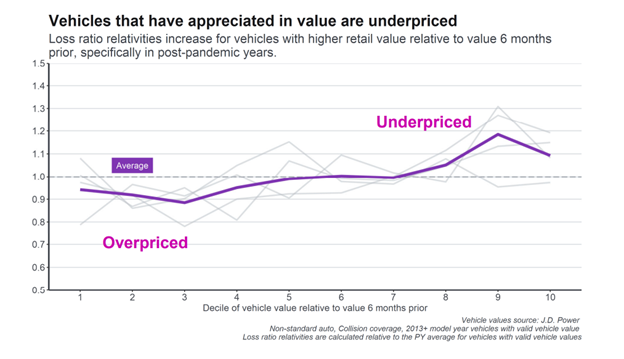

Liam explored the impact of rising vehicle values on pricing, explaining that the average used retail value for insured vehicles jumped after the initial pandemic shock. While changes in vehicle value, and more specifically vehicle depreciation, have historically been consistent across vehicles, he revealed that vehicle value changes have become more varied since the pandemic and that vehicles that have appreciated in value are being underpriced. He further discussed the impact of using real time vehicle value as an additional tool for segmentation and incorporating dynamic vehicle value into the pricing process.

I then dove into the topic of simplifying risk analysis with VIN-specific, as-built data and explored the following five themes:

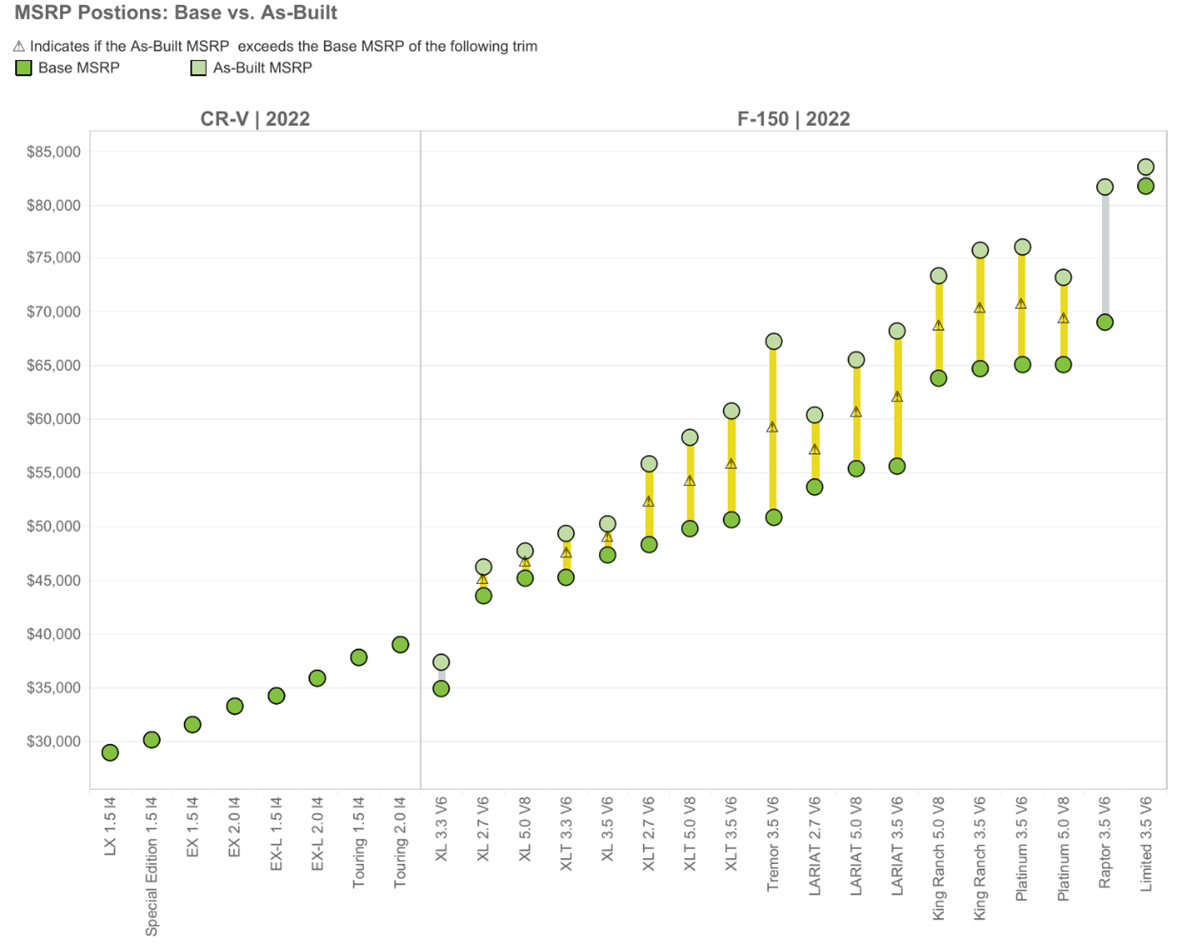

1. The differences between Base MSRP and As-Built MSRP can be significant.

Source: J.D. Power Helix

2. More complex vehicle technology is making it more challenging to accurately and competitively price insurance policies.

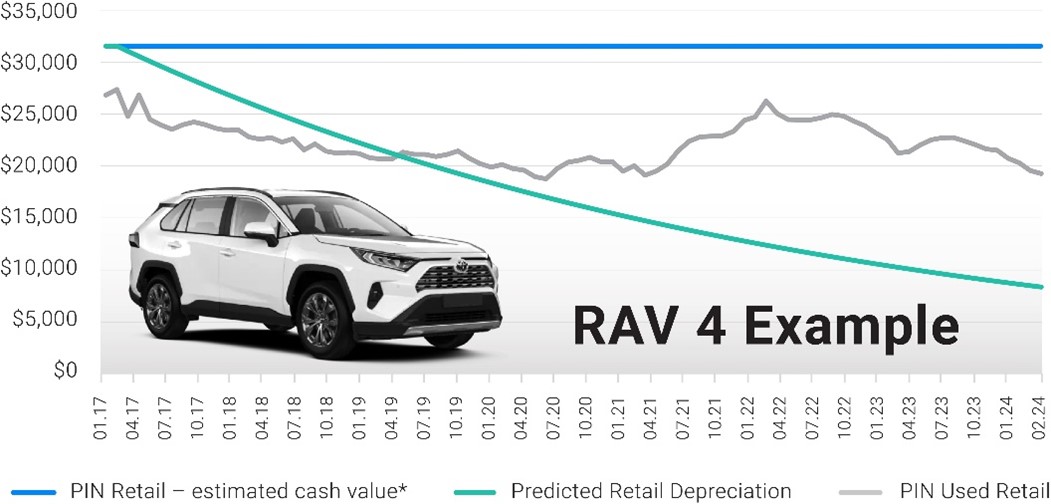

3. Inflation has made traditional vehicle depreciation curves obsolete.

*J.D. Power PIN, Model Year 2017 Sales

4. Traditional VIN decoding does not provide sufficient detail to identify individual vehicles’ precise value, resulting in imprecise values, costly oversights and ultimately missed opportunities.

5. Insurance carriers need valuations based on actual OEM build data and vehicle configuration information to reveal exact vehicle specifications.

Bottom Line: The insurance industry needs dynamic auto pricing symbols. If you’re looking to take the guesswork out of obtaining accurate vehicle valuations and eliminate manual processes and missed opportunities, let’s connect.

About the Author: Jim Vecchio is the Head of VIN Products for the Autodata Solutions Division of J.D. Power. Jim is a seasoned entrepreneurial executive who is focused on fueling data solutions across J.D. Power. Connect with Jim >

About the Author: Jim Vecchio is the Head of VIN Products for the Autodata Solutions Division of J.D. Power. Jim is a seasoned entrepreneurial executive who is focused on fueling data solutions across J.D. Power. Connect with Jim >

Where to find more insights like this:

This blog post is featured in the Insurance Insights monthly newsletter. Make sure you're signed up to get the latest insurance intelligence >

No Comments Yet

Let us know what you think