5 Mega Trends Influencing the Future of Annuities

It’s no surprise that the significant surge in individual annuity sales, particularly for fixed products, over the past few years has been the big story in the annuity space. LIMRA forecasts individual annuity sales to exceed $300 billion in 2024 and to continue growing in 2025.

Despite the recent attention, annuities often lack the excitement associated with other investment options. Annuities aren’t typically a hot topic of conversation outside of the industry and are often perceived as complex and challenging for customers to understand.

The confusion goes beyond the technical aspects, like contract terms, fee structures, and tax implications, as many annuitants also don’t fully understand how annuities fit into their overall investment strategy and retirement plan. Even so, the industry is well-positioned to enhance annuity products in the coming years while also improving the experience of annuitants and advisors, agents, and other distributors.

J.D. Power experts examine the 5 mega trends influencing the future of annuities and how we can expect customer-centric providers to respond in the coming years.

- Balancing product diversification with reducing complexity

- Leveraging data-driven and AI-powered annuity solutions

- Creating more personalized products and experiences

- Optimizing the servicing and sales experience

- Amplifying the value proposition of annuities in the minds of consumers

Balancing Product Diversification with Reducing Complexity

A clear trend in the individual annuity industry is the need to balance of offering a wide range of products while also making things simpler. Many annuity providers are expanding their offerings by introducing additional types of annuities to their suite of products. For instance, registered index-linked annuities (RILAs) are being offered as a good option for investors seeking to prioritize growth opportunities while minimizing potential losses. In Q4 2023 sales of RILAs surpassed the sales of traditional variable annuities (VAs) for the first time ever. It is an attractive alternative to fixed annuities (FAs) when interest rates are projected to fall in 2024. However, navigating these complexities poses a challenge, both for annuitants striving to understand the products they're investing in and for agents and financial advisors tasked with selling these products.

Data from the J.D. Power 2023 U.S. Individual Annuity Study highlights the significance of understanding the terms of the annuity. Annuity customers who fully grasp the terms of their annuity have a significantly higher Net Promoter Score (NPS®) of 55. In contrast, those with only partial understanding see a notable drop in NPS to 18, further plummeting to -19 for those who don't understand their annuity at all. More complicated products like VAs are more difficult for consumers to understand. 58% of annuitants with an FA completely understand their annuity terms vs. 54% of those with a VA, which is significantly lower. This underscores the critical importance of clarity and transparency in product communication and sales processes. As interest rates cool, attention may shift to VAs over the next few years, requiring annuity providers to explore enhancements to these processes in order to improve customer understanding.

Findings from the same study reveal that informed customers who are apprised of other products and services tend to be more satisfied and indicate a desire to expand their investment portfolios. However, as annuity providers introduce increasingly complex products to meet this demand, there's a potential risk of diminishing satisfaction levels. Therefore, while product diversification is essential for meeting the evolving needs of the marketplace, customer-centric annuity providers are likely to make concerted efforts to simplify and clarify product offerings, documentation, and communications to ensure customer comprehension and satisfaction.

Leveraging Data-Driven and AI-Powered Annuity Solutions

Annuity providers are likely to increasingly leverage advanced data analytics and AI to develop new products tailored to specific customer needs and risk profiles, while also considering market trends and the overall competitive landscape. The intersection of the vast amounts of data available to providers with current and future AI capabilities will pave the way for more dynamic risk assessment models, optimized distribution strategies, personalized product recommendations, enhanced efficiency and effectiveness of servicing processes, and targeted marketing approaches. This could lead to more personalized annuity offerings with features that better address consumers' needs. Finding the optimal distribution channel is an ongoing point of focus and concern for annuity providers, and advances in data analytics and AI could help providers identify the most effective channels for reaching target audiences and personalize marketing efforts to increase engagement and conversion rates. AI-powered tools can automate and streamline the distribution process, facilitating smoother transactions and improving overall customer satisfaction. This integration can empower providers to offer innovative solutions that better align with the evolving needs and preferences of investors, ultimately driving growth and competitiveness in the market.

However, annuity providers and distributors will need to stay on top of regulations and proactively address any customer concerns about the privacy of their data and the transparency of any AI-driven decisions, especially when it comes to pricing and risk assessment. As we mentioned above, there is already a knowledge gap for annuitants, so customer-centric providers will pay special attention to effectively communicating details around the use of new technologies and intelligence models with annuity applicants and customers.

Creating More Personalized Products and Experiences

Annuity owners are investors seeking products tailored to their unique financial goals and circumstances, and creating a more personalized experience will be a critical differentiator for annuity providers and continue to be a major focus over the next few years. Thus far, providers are responding to the need for personalization by offering more flexible annuity features, such as adjustable withdrawal rates, multiple payout options, and customizable riders addressing specific needs like inflation protection or long-term care coverage. While continued product enhancements are critical, personalized experiences cannot be ignored.

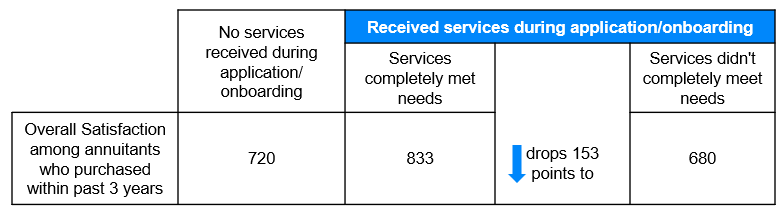

We know that tailoring communications to customer needs can result in significantly higher satisfaction. Customers who feel that their last contact from their annuity provider was tailored to their individual needs have an overall satisfaction score 143-points higher than those who didn’t feel that the contact was tailored to their needs. Even earlier in the relationship, during the annuity application process, providing individualized services can have a lasting impact on the annuitants’ impression and expectations of the annuity provider and their advisor or agent. During the application or onboarding process, one in ten annuity applicants report they didn’t receive any services, like documenting a financial plan, an explanation of the fees, or the development of a strategy to meet financial goals, and these applicants are significantly less satisfied than those who received at least one of these types of services. Out of the 90% of annuity applicants who did receive some type of additional services during application/onboarding, however, 23% indicate that these services did not completely meet their needs. In fact, satisfaction is even lower for those who received services that weren’t tailored to their needs vs. those who didn’t receive any services at all, illustrating the detrimental impact of not personalizing the experience.

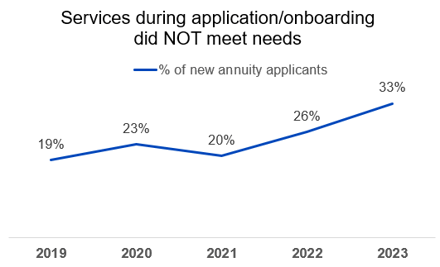

Concerningly, the proportion of new annuity applicants who say that services didn’t meet their needs has grown considerably from 19% in 2019 to 33% in 2023. Annuity providers need to address this trend as these initial interactions have lingering effects. For example, 32% of those who didn’t have their needs met during the application/orientation process regret their decision to purchase an annuity vs. 17% of those who had their needs completely met, and 45% of annuitants who didn’t have their needs met are unlikely to purchase any other products with their annuity provider vs. 29%, indicating that they are unlikely to do more business with the provider when their needs were met.

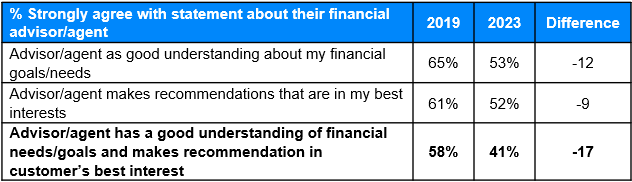

Financial advisors and agents often play a, if not the, prominent role in ensuring annuity customers purchase the annuity that best meets their needs and that customers receive individualized service. Satisfaction declines by around 90-index points if an annuity customer doesn’t strongly agree that the advisor/agent had a good understanding of the customer's financial goals/needs or that the advisor/agent made recommendations that are in the customer’s best interest. When the customer doesn’t strongly agree that the advisor/agent does either of these, satisfaction declines even further by 119-index points. Unfortunately, we’re also seeing a concerning trend here as advisor/agent performance in these key metrics has declined considerably since 2019.

The declining rates of meeting customers’ needs could point to issues stemming from the rapid incline in sales over the past few years. It is possible that annuity providers and advisors/agents are inundated with so many new buyers that it is hard to meet their needs or that new buyers’ unfamiliarity with annuity products leads to a mismatch between their expectations of the product they buy and the services they get vs. their expectations for each of these. It is also possible that consumers are comparing their experiences with annuity purchasing and servicing with the experiences they have across other industries, where they may feel that there is more opportunity for personalized products and services. Regardless of the driver, it is undeniable that the opportunity to progress the annuity industry in this area is present, and customer-centric providers are likely to put additional focus on aligning their product offerings, features and servicing capabilities with the preferences of individual annuity buyers and owners. (And leveraging data analytics and AI could play a major role in this.)

Optimizing the Servicing and Sales Experience

To better meet consumer needs and expectations, annuity providers are taking steps to offer customers more options to buy annuities and access services. The annuity industry is unique in that sales and servicing efforts from the annuity providers are often focused on the advisor or agent, which then trickles down to the end customer. But the rise in digital adoption, more sophisticated consumers with access to an unprecedented amount of product and industry information and shifting preferences in how customers want to interact with their annuity products is changing and influencing how annuity providers advance their sales and servicing capabilities. Gone is the idea of a low-touch, set-it-and-forget-it product, and here to stay is a more dynamic and interactive approach to meeting customer needs and preferences.

Third-party distribution is growing. Many annuity providers almost exclusively rely on third-party channels for sales and servicing, while some annuity providers who previously relied on captive agents and direct-to-consumer annuity sales have branched out to include some third-party distribution in their sales strategy. Although this has been a boon for sales and has the potential to allow annuity customers to view their annuity in the context of their entire investment portfolio, it doesn’t always result in the greatest sales or servicing experience for customers. Over the next few years, annuity providers will need to focus on ways to ensure there is a consistent experience across channels and do more to engage with both the customer and distributor to increase product understanding and foster engagement.

Digital transformation has also started to impact every aspect of the annuity purchasing and servicing experience, for both consumers and distribution channels. There is a growing emphasis on, and desire for, online accessibility and digital platforms.

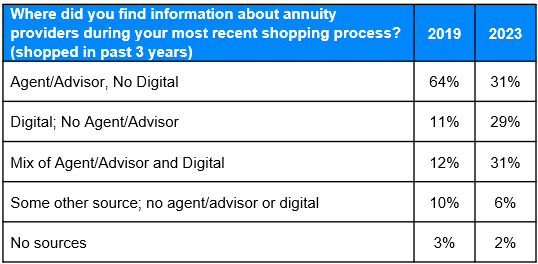

Digital Shopping: Our research shows that the sources an annuity shopper used to find out information about annuity providers have shifted significantly over the past 5 years, with shoppers relying less on an advisor or agent and more on digital channels (e.g., websites, blogs, social media, etc.) for this information.

Although digital engagement tends to have a positive impact on satisfaction (discussed below), during the annuity shopping process there are likely some gaps in the adequacy of digital as the primary source for information about annuity providers. Among those who found information about annuity providers only from their advisor or agent, 52% felt the shopping experience could have been better. More than half of shoppers is substantial, but when looking at annuity shoppers who only used digital means to find out information about annuity providers, 91% felt that something could have made the annuity shopping experience better. Overall, the top 3 ways shoppers indicated the process could have been improved are: an easier quote process, easy to read information, and tools to calculate payout. While better digital tools could help with these items, they will only improve the process if they are robust enough and provide clear and easy to understand information.

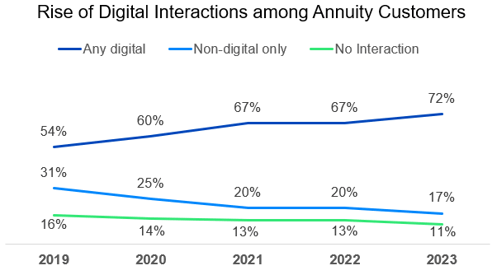

Digital Servicing: The addition of digital interaction in the servicing of an annuity post-purchase can have a tremendous impact on satisfaction, and usage has grown significantly over the past 5 years. Now 72% of annuity customers have had some sort of digital interaction with their annuity provider within the past 3 years vs. only 54% in 2019.

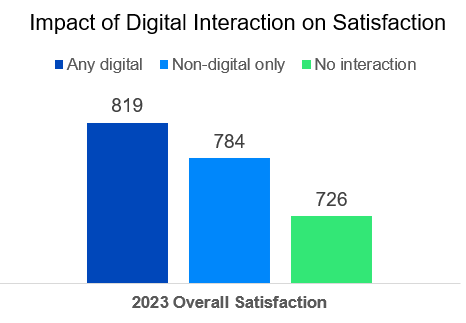

Satisfaction is dramatically higher for annuitants who have some sort of digital engagement vs. for those who only interact non-digitally (e.g., call center, advisor, agent, etc.) or have had no interaction at all within the past three years.

The use of mobile apps is also becoming more prevalent; although, many annuity providers haven’t caught up with this trend. In 2023, one-third (33%) of annuity customers indicated that they have interacted with their annuity provider via mobile within the past 3 years vs. only 21% in 2022. Annuity providers with more robust product lines, especially insurers with a suite of P&C products, tend to have higher app usage among their customers, likely because these brands already have the infrastructure in place for this type of digital development and customers are used to using an app to interact with their insurer. Other annuity providers will be playing some catch-up over the next few years, but those who invest in the digital experience will have a leg up on providing annuitants with a seamless experience, a hand in navigating the ins and outs of their annuities, a better understanding of the product, and the capability to better track performance and view their annuities in the context of their investment portfolio and retirement plan.

As access to more servicing channels and customer engagement increases, receiving a seamless experience across channels becomes a more relevant need in the overall customer experience. This includes interactions with advisors, agents, and others servicing annuity products. Providers must ensure that advancements in digital capabilities consider the impact of the tools on advisors, agents, and any third-party distributors. Essentially, digital advancement should aid advisors and agents in better understanding the customer and how they sell and service annuities, enhancing the experience for both the customer and them. Customer-centric annuity providers will ensure digital transformation encompasses the entire experience inclusive of channels, interactions, and stage within the customer journey.

Amplifying the Value Proposition of Annuities in the Minds of Consumers

The final mega trend we will examine is the movement to improve the perceived value of annuities. Recent attractive interest rates leading to the increase in sales of fixed annuities helped greatly expand awareness of annuities as a solid investment choice for retirement income. But, as interest rates drop, will annuities get pushed to the backburner of both consumers’ and distributors’ minds? We already discussed product diversification (balanced with limiting complexity) as a trend, but positioning the value of annuities goes beyond having product options.

Annuity providers will look to communicate value by demonstrating how products and services address specific customer needs and concerns within the context of the evolving financial market. For example, results from the J.D. Power 2023 U.S. Individual Annuity Study revealed that protecting retirement income was the top reason customers purchased their annuity. With the expected decrease in interest rates, focusing on the protection features annuities offer will be key to communicating the value proposition. Longevity risks are also an emerging concern for both annuity providers and annuitants. Promoting the benefits of a deferred income annuity as a longevity annuity can help providers ensure customers don’t outlive their income.

Overall, many people may not see how valuable annuities truly are, and communicating the value will help increase consideration and purchase of many types of annuities. Annuity providers will also benefit from helping consumers better understand how annuities fit into their overall financial plan, giving a more holistic view of how different types of annuities can benefit consumers in different ways. Customer-centric annuity providers will likely prioritize financial wellness initiatives and educational resources to empower consumers to make informed decisions about retirement planning and annuity products, helping them to understand the full value of their purchase.

Closing Thoughts

As more consumers approach retirement age, annuities will continue to be a popular way to protect retirement income. By increasing personalization of products and services, expanding features, and enhancing sales and servicing approaches, the annuity industry will be better equipped to meet the evolving needs of customers. The complexity of annuity products, however, will continue to be a hurdle the industry must overcome. By focusing on clear, effective communication, customer-centric brands will be best positioned to engage with shoppers and build strong relationships with annuitants. It's important to note that these are just potential trends, and the actual future of individual annuity sales and servicing will depend on various factors, including technological advancements, regulatory changes, and consumer preferences. Providers that incorporate continuous customer experience feedback data and intelligence into their strategies can better understand and respond to evolving trends and customer needs, driving engagement and loyalty, and ultimately, differentiating themselves in the market through exceptional customer experiences.

Data Source: J.D. Power 2019-2023 U.S. Individual Annuity Studies

About the Author: Breanne Armstrong is Director of Insurance Intelligence at J.D. Power. Her area of focus is on the customer experience in auto, property, and individual life insurance and annuities. She has over 15 years of research and consulting experience and 7 combined years at J.D. Power working within the Insurance Practice.

Where to find more insights like this:

This blog post was featured in the Insurance Insights monthly newsletter. Make sure you're signed up to get the latest insurance intelligence >

Net Promoter® and NPS® are registered trademarks of Bain & Company, Inc., NICE Systems, Inc., and Fred Reichheld. Net Promoter ScoreSM is a service mark of Bain & Company, Inc., NICE Systems, Inc., and Fred Reichheld.

Share this

You May Also Like

These Related Stories

5 Mega Trends Influencing the Future of Life Insurance

Auto Insurance Acquisition vs. Retention: What Gets Customers to Stay?

No Comments Yet

Let us know what you think