In the insurance industry, carriers are fighting an uphill battle to generate mobile adoption. Digital is a hot topic in almost any industry these days. Many companies have made investments in mobile apps before they had a strategy to incorporate them into their customer service delivery process. In the insurance industry, carriers are fighting an uphill battle to generate mobile adoption given the relatively low touch nature of their products. While mobile apps have become an important customer service channel for industries ranging from banking, to airlines, and even utility and mortgage companies, insurance carriers have struggled to make mobile a legitimate service channel due to the lack of insurance specific tasks and the ease at which the mobile app replaces or compliments the previous channel.

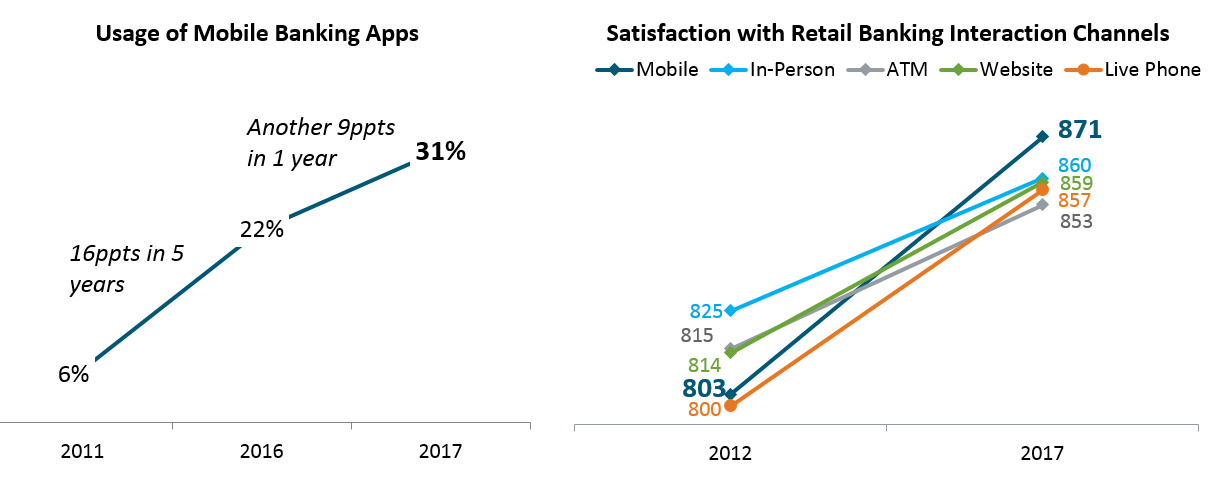

Before breaking down those two issues it is important to first look at past mobile trends in industries we think of today as leaders in mobile app servicing, of which, retail banking offers some of the best examples. Despite the enormous investment the Big Banks were making into their mobile channel(s), the proportion of customers engaged with their retail bank’s app was minimal and growth over time was relatively lackluster. Of course, the digital native generations were early adopters of the channel; however, it wasn’t until bank-specific functionality that added value to the customer was introduced that usage of the apps accelerated on a mass scale. The figures below illustrate the growth in customer use of mobile banking apps from 6% in 2011 to 22% in 2016—a 16 percentage point increase over the course of 5 years; however, in just one more year, incidence grew to 31%. During the same time, customer satisfaction with mobile as a channel grew from being one of the least satisfying channels to by far the most satisfying channel. So, what changed?

The introduction of mobile check deposit, on a mass scale, changed the way customers thought of mobile apps as a service channel for two reasons. First, mobile check deposit is a banking-specific function which moved the app away from a novelty because “everyone has an app”. Second, and most critically, the functionality created significant value for the customer by transitioning the activity of depositing a check in a physical branch to the customers’ fingertips, significantly reducing the time and effort it takes to complete the task. 2018 retail banking mobile app incidence continued to grow, and it is currently at 54% of all customers.

Insurance companies are just now entering the beginning stage of customers slowly starting to download their insurer’s mobile app; however, few customers are using it on a regular basis for the same principles retail banks had to overcome before the channel could become successful. Nearly two in ten (19%) customers have at least at one point downloaded their insurers app and, among those, only 23% use the app monthly; compared to 66% of banking customers using the app on a weekly basis.

It is true, apples to apples, there are fewer occasions customers would need to interact with their insurer on a monthly basis relative to their bank; however, it seems there are still opportunities to close the gap on key tasks. Billing and Payment for example check off both, at least partially, of the aspects that led to the success of banking apps. It is an insurance specific activity that adds value to the customer through a greater level of convenience than the previous most convenient method of online bill pay. That said, if we compare Billing and Payment back to the retail banking example, moving from a branch-check deposit to mobile-check deposit has a substantially greater change in the scope of effort that customers moving from web-bill pay environment to a mobile-bill pay environment.

The fact the transition is Web to Mobile vs. Branch (i.e., physical location) to Mobile means the degree of effort is not that dramatic; given the maximum cadence of an insurance customer’s payment is monthly—also keep in mind the percentage of customers who pay on an annual and bi-annual basis as well as the percentage of customers who pay their homeowners premium through an escrow account with their mortgage.

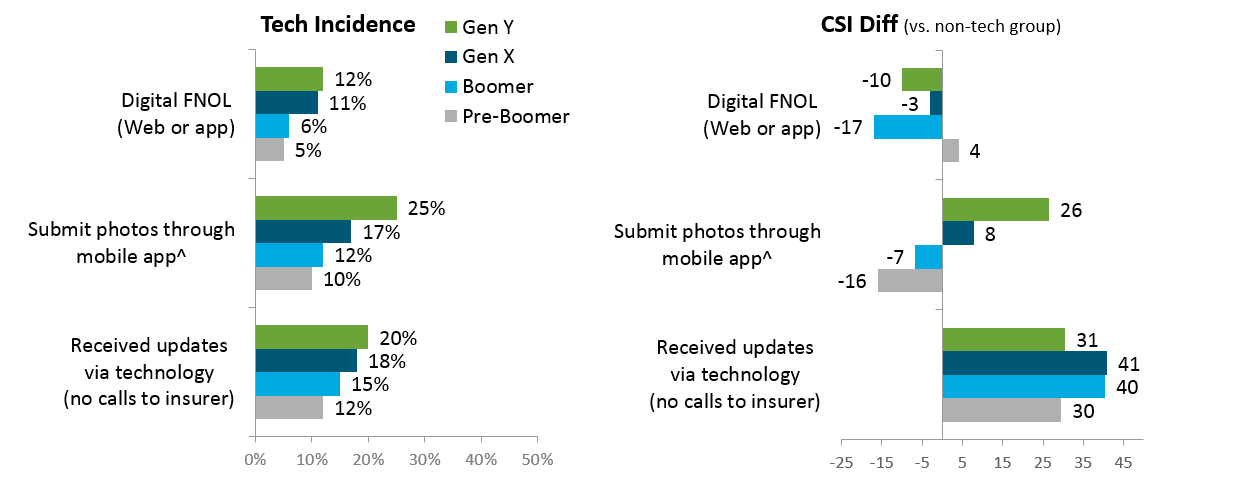

The functions that seem on the horizon to check off both boxes are submitting photos for claims and receiving updates on the claims process through the mobile app. Currently, receiving updates via tech is beneficial to all generations as it is a low-touch, low-effort way for customers to receive information on the status of their claim. Submitting photos is currently mixed in terms of satisfaction with younger generations reporting a better experience. Once more, going back to the retail banking example, submitting photos transitions the customer experience from physical location to anywhere with a cell signal.

With respect to claims, the biggest barrier for insurers is going to be adoption. While customers are reporting a vastly greater experience when they use technology during the claims process, it is highly unlikely the customer is going to download the mobile app at the time they have a claim. The J.D. Power 2018 U.S. Auto Claims Satisfaction Study finds customers who had the mobile app downloaded prior to experiencing a claim were much more likely to use the app throughout the claims process and thus have a better experience due to features such as digital updates and submitting photos via the app. The evidence suggests insurers may have found insurance specific features to create value for the customer, but the acceleration of adoption is delayed given the frequency at which claims occur per policy. Insurers can likely accelerate the duration until critical mass is reached by focusing on or identifying new features which warrant customers to take up valuable real-estate in their mobile app wallet for their insurers app prior to having a claim.