In an industry of few interaction touchpoints, first notice of loss (FNOL) is one of the most important components of the customer experience for insurance claimants.

Providing an exceptional FNOL experience is key to driving high levels of customer satisfaction and advocacy. Two important things play a role in a satisfactory FNOL experience: the number of services provided, and the types of services provided to customers in their time of need.

According to the J.D. Power Auto Claims Satisfaction StudySM and Property Claims Satisfaction Study,SM FNOL comprises a quarter of the customer satisfaction index model (25% and 26% for the respective studies). Insurers are tasked with providing a sense of calmness and ease in the claimant’s lowest moment. This is not an easy up taking. However, providing the appropriate services for automotive and home owners is crucial in supporting the claimant and building trust. Let’s consider a typical FNOL for an automotive claimant.

The number of services provided at first notice of loss plays a big role in overall satisfaction and helping claimants feel more at ease. The main services that can be provided at FNOL for an auto claim include reserving the rental car; arranging a tow; scheduling an estimate; providing repair facility options; notifying the repair facility; providing contact phone numbers; and recording an official statement of the incident.

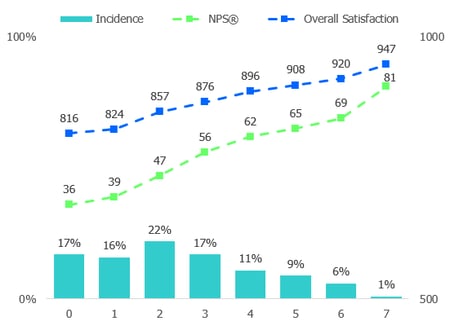

Almost one in five (17%) auto claimants indicate not receiving any of these seven services during FNOL. As more services are provided, overall satisfaction and advocacy increase. In addition, compliance with one of the most important KPIs, Claimant felt more at ease after reporting the claim, increases as more services are provided during FNOL.

Impact of Number of Services Provided at FNOL

(Satisfaction scores on a 1,000-point scale)

Source: J.D Power 2018 U.S. Auto Claims Satisfaction StudySM

Note: Net Promoter, Net Promoter System, Net Promoter Score, NPS and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.

Certain services and combinations of services at FNOL are inherently more valued by claimants. The services at FNOL that contribute to the greatest levels of overall satisfaction include scheduling the estimate; making the rental vehicle reservation; and notifying the repair facility.

Providing more common services that claimants expect to be a part of the FNOL experience—such as recording an official statement and providing contact phone numbers—doesn’t offer as much upside in terms of improving the overall CSI. However, not providing these services at FNOL can drive down the overall CSI, as satisfaction falls from an Industry Average of 883 (official statement recorded) and 881 (contact numbers provided) to 833 and 823, respectively, when these services are not provided.

Satisfaction with Services Provided at FNOL

(Satisfaction scores on a 1,000-point scale)

Source: J.D Power 2018 U.S. Auto Claims Satisfaction StudySM

In summary, the FNOL is of vital importance for insurers. It can make or break customer satisfaction and advocacy. It is no longer enough for insurers to just provide common services such as recording an official statement, providing contact numbers, and arranging a tow. Although these basic services are still expected, providing services that go above and beyond such as notifying the repair facility, reserving a rental car, and scheduling an estimate can help take a customer’s experience to the next level. Providing more services increases the likelihood that claimants are “Delighted” with their claims experience. These “Delighted” customers are in turn more likely to be loyal to and advocates for their insurer.

Satisfaction Tiers Based on Number of Services Provided at FNOL

Source: J.D Power 2018 U.S. Auto Claims Satisfaction StudySM