In many cases, more of something is better than less. However, insurers that blindly apply this logic to the way in which they interact with customers may be overlooking opportunities to effectively communicate with them. While the importance of effective communication is not a new topic by any means, it continues to be an evolving one, as advances in technology present an ever-changing moving target. Insurers that intentionally consider the volume, type and content of communications will be more successful in effectively communicating with their customers, ultimately leading to more satisfying experiences, which translates into higher levels of advocacy and retention.

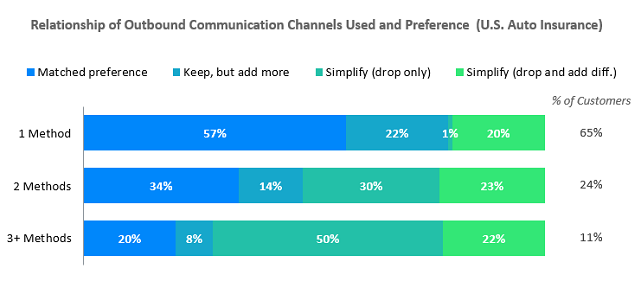

It is imperative that insurers communicate with customers in the ways in which customers want to be communicated. Using auto insurance as an example, two-thirds of customers are contacted by their insurer via only one method of communication. In most cases, this method aligns with the customers’ only preferred contact method; however, 22% of this single-contact group would like additional methods of communication, while 20% would like a different method used instead of the specific type of communication received. The disconnect in communication method(s) used matching preferences grows as the number of utilized methods increases—the majority of customers receiving two or more communications from their insurer feel this was either too many or not the right mix of methods used.

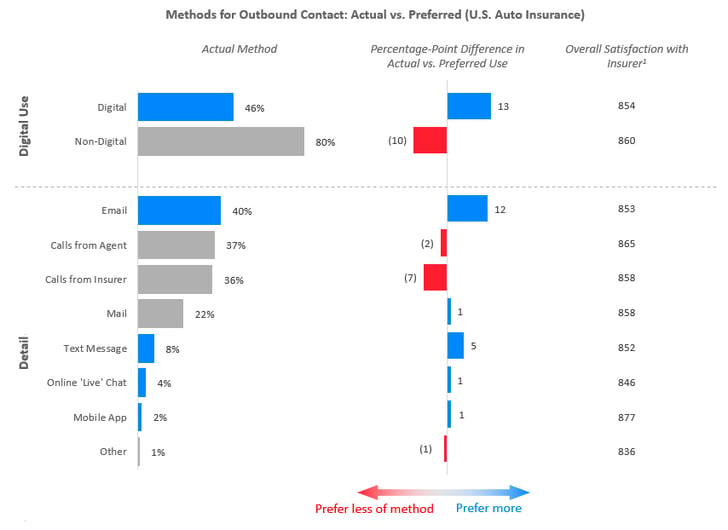

Auto insurance customers are more likely to receive non-digital communication from insurers than digital communication. However, more customers are receiving non-digital interaction than would prefer it, while the opposite is true of digital communication, indicating that there is an opportunity for increased use of digital methods for insurer outreach (59% preference vs. 46% actual use). A complete shift toward digital communication in place of non-digital interaction is not recommended, as a higher proportion of customers still prefer use of non-digital communication vs. digital communication. However, the key is to identify the ways in which specific customers desire to be interacted, and then to increase the quality/value of the digital communications when they are used, as overall satisfaction is higher when customers receive a non-digital outbound contact, compared to when they receive a digital outbound contact.

For example, while email is already the most commonly used method of outbound communication, there is opportunity to expand its use. Just over one-half of customers (52%) prefer email be used, compared to only 40% receiving emails from their insurer. This 12-percentage-point gap represents the greatest gap in preference vs. actual use among the seven specific types of communication measured.

Beyond email, the other three forms of digital communication measured among auto insurance customers also represent opportunities for increased use, with text messaging following email as the second largest gap between preferred and actual use (13% vs. 8%, respectively). Conversely, calls (from an agent and/or from the insurer directly) are being overutilized.

A move toward a more digital-centric outreach strategy will require changes beyond simply adjusting the type of communications though, as customers who currently receive email, text message or online ‘live’ chat communication from their insurer are less satisfied with their insurer overall, compared to those who receive communication via other methods. Thus, the content/clarity of digital communication needs to be improved in order for it to be viewed as effective.

The purpose of the communication also plays a role in determining the most effective channel. For example, when looking specifically at auto insurance claimants, calls from the insurer outweighs email as the most preferred method of status updating (54% vs. 42%, respectively), followed by calls from the repair facility (38%). Within the claims space, insurers do not necessarily need to focus on providing more digital communications overall, but there are ways to improve the claim experience by tailoring use of digital, and non-digital, communications to customer preferences and by focusing on the methods that are associated with higher levels of satisfaction.

Methods associated with a high level of effort, such as making calls, are tied to lower satisfaction levels. This does not bode well for insurers, as two-thirds of claimants feel the need to make a call to their insurer during the claims process, while 13% call an agent. Methods that are less intrusive, low effort and/or reflect personalized service garner the highest scores for overall satisfaction with the claim experience, such as text messaging, calls from an agent and mobile app. Text messaging is the only update method that claimants want used more often than it currently is, and increased use of this method can also benefit insurers, given that this option yields the highest overall satisfaction score. The relatively high-level of satisfaction when text messages are used to provide claims status updates and the fact that this method is more commonly preferred by claimants than by auto insurance customers in general illustrates that specific methods of communication can be more effective in certain instances than in others.

Aligning communication methods to customer preferences is only one aspect of effective communication though. This is particularly evident throughout the claims process, in which clarity and thoroughness of communication is critical to ensuring a highly satisfactory experience. When done well, communication can be used to appropriately set expectations and overcome a negative part of the experience, if one occurs. For example, auto claimants who have their vehicle returned to them in more than 10 days, but who have also had expectations properly set through the use of critical communication KPIs, are more satisfied with their overall claims experience than those who have their vehicle returned to them more quickly.

Communicating in the ways in which customers want to be communicated, aligning types of communication to specific uses and increasing the quality/content of digital communications can enable insurers to more effectively communicate with their customers.

1Satisfaction scores are based on a 1,000-point scale