The P&C insurance industry continues to undergo unprecedented change. Customers are empowered in the shopping and servicing of their policies like never before. Customer experience leaders from outside of the insurance industry, such as Amazon and Netflix, continue to set a high bar in terms of digital interactions and to influence customers’ expectations of their insurance providers. Insurtechs are changing the insurance value chain. At the same time, the personal lines auto industry is facing an uphill battle in terms of profitability and in terms of a market that is mature and has few new customers to target.

The Shift to Consumer Brands

In a market with limited growth, insurance companies have few options but to battle each other for consumers’ business. Considering there are less than 2% of new entrants to the auto insurance market each year, insurer growth often requires taking share from a competitor. This places a huge focus on brand differentiation and conveying value.

Companies must look to their brands and communicate what value they can bring that competitors cannot. Two of the fastest growing carriers in recent years, GEICO and USAA, have experienced impressive growth by delivering on a clear value proposition to their chosen segments of the insurance market. Put simply, insurance carriers are now functioning as consumer brands, and must find ways to attract and retain customers by differentiating themselves in a crowded marketplace.

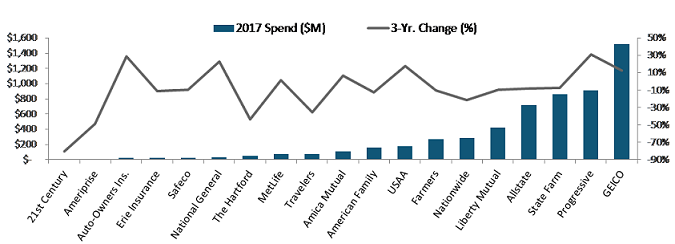

So far, advertising has played a key role in that effort. Advertising spend in 2017 increased by a staggering 62% over a ten‐year period, signifying a long‐term shift towards a consumer‐centric marketing approach that is focused on communicating brand value to consumers to win their business. Market share leaders consistently spend more on advertising than their competitors, underscoring the impact that heavy advertising spend and consumer‐centric marketing have on winning new business.

Source: S&P Global market Intelligence and J.D. Power Analysis. ^2017 data is preliminary and subject to change.

The Value of Top-of-Mind Recognition

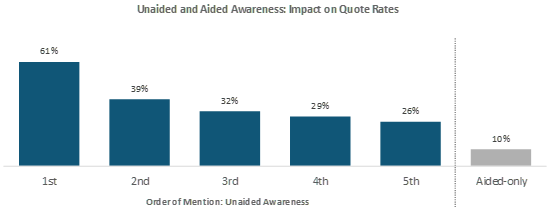

Companies that spend more on advertising have greater brand recognition—or awareness. Yet, not all brand awareness is created equal. Top-of-mind recognition, or unaided awareness, is particularly essential in quoting a customer. Quote rates for unaided awareness show that beyond the first brand, which is typically a shopper’s current insurer, brands that are recalled on an unaided basis second, third, fourth, and fifth are more likely to be quoted and bought from than brands that are only recognized on an aided basis.

Understanding the competitive landscape today and what’s on the horizon will be key to refining a successful marketing strategy to win new business. Look for the forthcoming release of the 2019 Insurance Shopping Study in April, where there will be an in-depth examination of these issues and trends.