The growing preference for digital servicing, which is not limited to but accelerated by the next generation of customers, is putting pressure on the industry to answer a very tough question—what does the future look like for the insurance agent?

Evolving Customer Expectations and an Inflection Point for Agents and Insurers

Customer preferences and expectations for interacting with their insurance company are shaped by a myriad of interactions in their daily life that transcend common generational preferences. In 2018, 77% of U.S. adults own a smartphone, up from 35% in 2011 when the Pew Research Center first began collecting information on smartphone ownership.1 As a result, digital has become a critical service channel, with companies like Uber, Netflix, and Amazon Prime changing the way customers expect to interact with the companies they do business with—including their insurer.

The growing preference for digital servicing, which is not limited to but accelerated by the next generation of customers, is putting pressure on the industry to answer a very tough question—what does the future look like for the insurance agent?

The trends today somewhat mirror the disruption in the financial advice industry roughly 25 years ago when online trading platforms, such as Scottrade, began to attract a significant share of investors. Feeling the upheaval, the industry was forced to ask itself what the future held for financial advisors. As a result, firms and financial advisors tailored their products and services to focus on more affluent clients with complex needs and shifted their value proposition from investment management to financial planning.

Pervasive Use of Digital Services and Mobile Apps

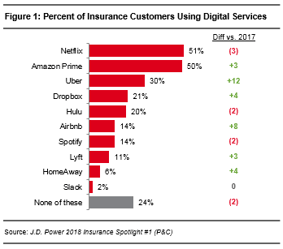

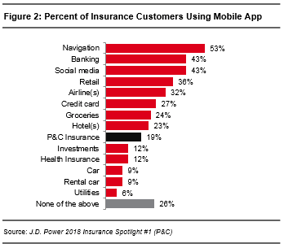

Fewer annual interactions in insurance means fewer customers immediately converting to the mobile app for servicing needs. That said, the growing use of digital services shown in Figure 1 and the pervasive use of mobile apps as a key customer service channel in adjacent industries from Figure 2 are beginning to recondition P&C customers to think online-first.

Between April 2017 and April 2018, the percentage of insurance customers that have used Uber at least once has grown by 12 percentage points to 30% in 2018. Putting the issue of reduced vehicle ownership aside, that is a substantial increase in the number of customers replacing a traditional service or means of transportation with a more convenient, digital-based, alternative.

Financial services, banking, credit card, and even grocery services top P&C insurance in the usage rates of mobile apps as a service channel. Banking and credit card mobile/digital interactions may be the most critical for insurers to understand because they are setting customers’ expectations on a more frequent basis than Amazon, Netflix, and Uber. Based on frequency of use, on a weekly basis, customers use their banking, credit card, and investment apps as much as they use Netflix for entertainment.2 That is a significant level of engagement given mobile is still a relatively new channel for financial institutions and not all institutions offer those capabilities.

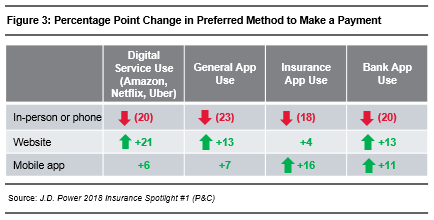

The convenience and ease of doing business are major influencers of these shifting preferences. Customer preferences for making an insurance payment changes drastically based on whether they use such services as Netflix and Uber; use mobile apps in general; use an app for banking; or have their insurer’s mobile app (Figure 3). The website channel certainly accounts for most of the shift away from phone, in-person, and mail; however, among customers that have either their insurer’s mobile app or a mobile app for banking would prefer to use an app for making an insurance payment.

Perhaps the more critical component for some insurers is how the shift to self-service for transactional needs changes customer expectations for the role of their agent or insurer representative, as well as the types of activities customers will continue to expect their agents to handle directly. Broadly speaking, customers using self-service are less likely to rely on their agent for all their needs, but they still prefer discussions about price changes or policy coverage/changes in person or over the phone with an agent or representative (Figure 4). Reserving high-touch live channels for high-value needs and the organic, customer-driven realignment of transactional needs to low-cost digital channels have several benefits for agents, customers, and insurers, all of which will likely help pave the way to taking the agent’s role to the next level.

Taking the Agent’s Role to the Next Level

The current agency model—in which agents are the intermediary between the insurer and customer—has been slow to adapt to evolving customer expectations. In part, that change has been slow because the model has been successful for a significant number of years and some legacy agents may be reluctant to change. To meet customer demand for change, insurers need to consistently communicate the below benefits to agents. Alleviating the burden of servicing relationships, answering billing questions, and adding drivers, among others, will allow agents to focus more time on revenue-generating activities and better understanding their customers to build deeper relationships.

However, to fully realize these benefits, insurers and agents need to transition the core value proposition of the agent from product sales to a partnership and guidance model. The transition needs to occur both internally from a cultural standpoint and externally in terms of customer perceptions of agents and insurance in general.

Training and Hiring for Soft Skills Will Become Critical

Part of the above transition includes how agents present their role to customers and the skills needed to be a successful partner. Again, looking back to when financial advisors transitioned the core value proposition of their role from investment management to financial planning, there was a need to focus on the soft skills required to build deeper, trust-based relationships with customers to understand their needs and make appropriate recommendations and plans. Currently, insurance agents are vastly behind financial advisors in their understanding of customers, which is acutely evident to customers (Figure 5).

Even among the 57% of customers who view their agent as their primary point of contact, only 28% of them strongly agree they have the soft-skills to develop a trusted relationship.

In working as a partner, agents can develop a deeper understanding of their most valuable customers—those with more complex needs—and be able to anticipate when those needs may change over time and tailor a solution when needed. Trust-based relationships also have a significant impact on the customer experience: when customers say they “strongly agree” that their advisor or agent consistently met all five of the soft skills required to build a trust-based relationship, customer satisfaction increases 28%, compared with those who did not “strongly agree” their advisor or agent met any of the required skills, and, in the same comparison, the percentage of customers who say they “definitely will” renew increases by 150%.

Digital Interactions Will Foster Change to the Agent Value Proposition—and That is a Win-Win-Win

As customers’ lives become increasingly digitized by services from Amazon to Uber and interactions in other industries continue to migrate to mobile as a critical customer service channel, insurance customers’ preferences and expectations will likely shift to digital as well. As a result, the role of the agent needs to become more focused on revenue-generating activities—rather than service—and on developing deeper, trust-based relationships that can ultimately lead to a greater lifetime value by improving the ability to meet the changing needs of customers and by providing the opportunity to uncover cross-sell opportunities. From a customer’s perspective, an integrated, multichannel experience that includes online and offline interactions leads to the highest levels of satisfaction and renewal. While the transition of a successful and proven business model can be long and challenging, there are clear benefits for insurers, agents, and customers—making it a win-win-win proposition.

1Source: Pew Research Center; Surveys conducted 2002-2018; http://www.pewinternet.org/fact-sheet/mobile/

2Source: J.D. Power 2018 Insurance Spotlight #1