With the current combined ratio in personal lines running around 103%1 and a steady increase in the LLAE ratio for the P&C industry,2 every claim organization will be pressed to show improvement in their operational effectiveness.

Couple that reality with a slight decline in the overall Customer Satisfaction Index as reported in the J.D. Power 2017 U.S. Auto Claims Satisfaction StudySM along with the steadily increasing growth of new Insurtech organizations’ clearly defined focus on the customer experience, and the traditional claim organization is faced with a monumental task.

How does today’s claim organization improve effectiveness and provide a better customer experience, reduce or maintain costs, and still apply the proper controls and processes to effectively adjudicate claims?

The 2017 Auto Claims Satisfaction Study survey conducted by J.D. Power identifies several points within the claim process for management to focus on that will allow them to more effectively direct resources in order to better leverage technology for a more satisfying claim experience. First and foremost, claim organizations must make the customer experience a key targeted outcome when designing the claim processes. The 2017 study found that the Claim Servicing factor, defined as the key interactions between all of the different claims professionals handling the claim and the customers, accounted for 29% of the overall Customer Satisfaction Index and the First Notice of Loss factor was 25% of the index. Claim Settlement was 26%, with the Rental Experience, Estimation, and Repair Process factors accounting for the rest of the overall index.

No matter what the outcome of the claim or final settlement is, if the customer experience is negative, the chances of renewing that customer is significantly reduced, placing more pressure on the carrier to write new business, which has historically experienced 10% to 30% higher loss ratio depending on the line and underwriting cycle than renewals.3 A customer who says they were “delighted” with their experience (best experience) is 30% more likely to renew than a customer who is only “pleased” with their experience and 80% more likely to renew their policy than a customer who is “displeased.”

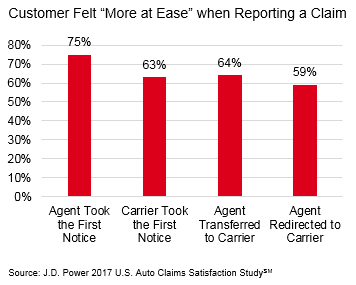

As carriers drive toward streamlining their processes and reducing the time required to adjudicate claims, they often minimize the human touch in the process. A customer who has had an auto or property loss not only wants their claim processed in a reasonable time, but they also want to generally understand how long the claim process will take in order to feel like everything is going to be okay. For example, our study indicates that agents who redirect customers to an intake center or website for their first notice of loss experienced a significant drop in overall satisfaction among those customers, while the highest satisfaction is when the agent takes the first notice of loss directly. Our Auto Claims Satisfaction Study found customers, regardless of age, felt more comfortable speaking to a person about their claim without being bounced around among several people.

The first contact with a customer after a loss is critical to overall satisfaction. When an agent is involved, satisfaction scores are significantly higher. That doesn’t mean technology doesn’t or shouldn’t play a role in the process—it absolutely should— but it cannot replace the human experience.

What the 2017 Auto Claim Satisfaction Study also clearly pointed out was the need for a collaborative effort between technology and human interaction. Having a sound FNOL process that puts the customer at ease is the baseline for an overall higher level of satisfaction. However, the study also found that having a strong technology solution that provides updates and assistance to customers can enhance the claim experience. The updates and assistance should be active connections that provide value to customers or at least don’t impose some work on them.

For example, sending a text message to a customer telling them something has changed with their claim, without much detail, is a passive update that requires the customer to take some action to understand exactly what changed and why. This increases the level of effort on the part of the customer and reduces their satisfaction. Only 73% of customers who received a digital update and needed to follow up said that the communication was adequate. In contrast, an active email to the customer that provides a more detailed narrative about what has changed and why eliminates the need for the customer to respond to the email or to ask questions, which increases the level of satisfaction. Overall satisfaction among customers who received status updates without having to call their carrier was 35 points higher than among those who didn’t receive updates, and 92% of these customers felt the overall communications was adequate.

It is a difficult balance for a claim organization handling personal lines to be responsive to both efficiency and effectiveness demands and to create a positive customer experience, but the information from our Auto Claims Satisfaction Study can help management make better decisions to ensure they get the best results. To meet the ROI challenges, carriers need to develop a clear technology strategy that reduces costs and increases efficiencies while improving customer satisfaction. In any case, organizations cannot overlook the human element—whether through agents or internal service professionals—if they expect to achieve a high level of customer satisfaction.

1Beth Fitzgerald (Verisk) and Robert Gordan (PCI), Property & Casualty Insurance Results: 2016, (2017). https://www.verisk.com/siteassets/media/downloads/insuranceresultsreport2016q4.pdf, page 2.

2Fitzgerald (Verisk) and Gordan (PCI), Property & Casualty Insurance Results: 2016, page 1.

3Cheng-Sheng Peter Wu and Hua Lin, Large Scale Analysis of Persistency and Renewal Discounts for Property and Casualty Insurance, Casualty Actuarial Society, E-Forum, Winter 2009, Introduction.