How are digital channels influencing customer expectations of the claims process?

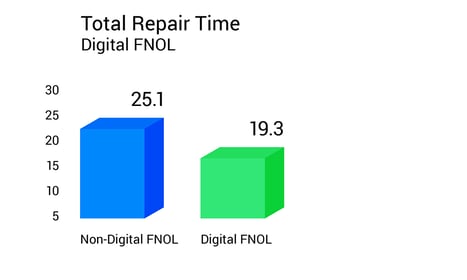

Digital processes are speeding up claims for those who use them. Customers who report their claim digitally, have a total repair time of 19.3 days which is nearly 6 days shorter than non-digital users. While these claims tend be of lower severity, customer are having a notably quicker experience when starting in digital channels.

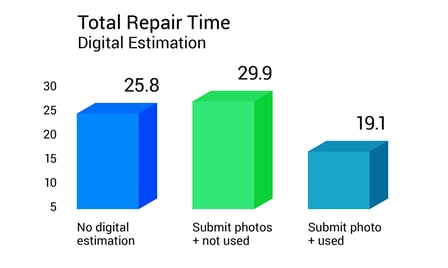

Similarly, customers that were able to submit and use digital photos for their estimate report a shorter cycle time as well.

While these digital processes are showing faster claim resolution, they are not always meeting customer expectations for how digital will impact the claim length. When we asked customers how long their claim took to resolve and how that compared to their expectations, we found that those who reported their claim digitally and submitted photos that were used for the estimate had an average claim length of only 10.9 days when their expectations were met. So, the expected claim length is very short for those using these digital channels.

For comparison, among those who used a digital channel for either FNOL or estimates indicated that their claims lasted 16.1 days, on average, when meeting expectations. And among those who did not use digital channels for either of these experiences had an average claim of 23.4 days when meeting their expectations—more than 12 days longer than those using digital channels for both.

While digital tools do create a quicker process, the shorter claim time is no longer an added bonus but an increasingly difficult expectation to meet. With non-digital tools and interactions required within the larger claims process, how are you ensuring that your channels are working together smoothly to deliver on customer expectations?

Subscribers to the J.D. Power U.S. Property Claims Satisfaction Study have access to the latest insight into customer expectations and insurer best practices for delivering a claims experience that will delight customers. If you’re not yet a subscriber, contact your account rep today.

Data Source: J.D. Power 2024 U.S. Property Claims Satisfaction StudySM

About the Author: Mark Garrett is a Director for the Insurance Intelligence Practice at J.D. Power. His primary focus is on Auto and Property claims, including the digital experience. He works with many of the top 30 insurance carriers consulting on study findings and advising on opportunities to improve the customer experience.

Where to find more insights like this:

This blog post was featured in the Insurance Insights monthly newsletter. Make sure you're signed up to get the latest insurance intelligence >

No Comments Yet

Let us know what you think