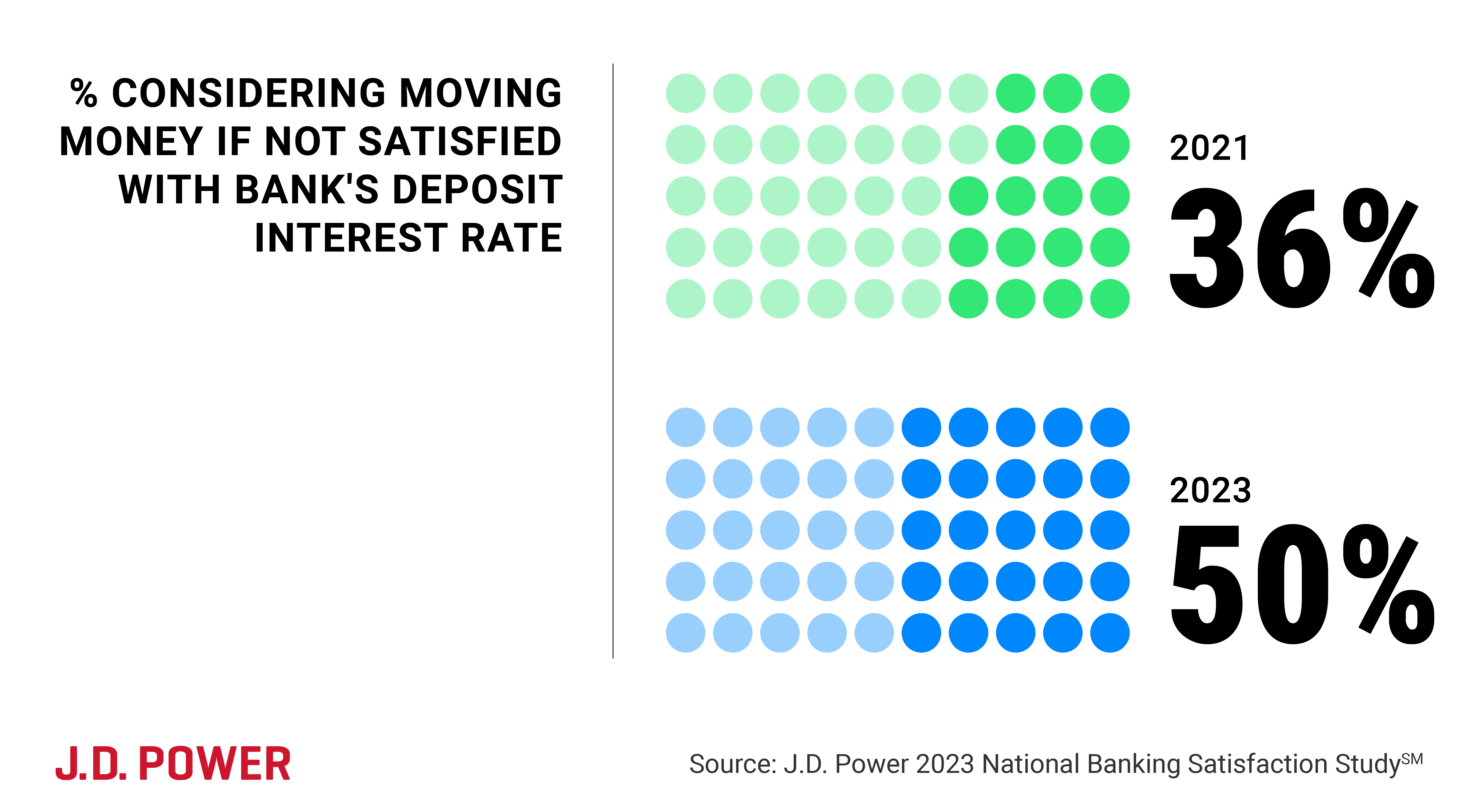

With rates plummeting like a lead balloon, customers are ready to take their money and run. With rates failing to impress, the likelihood of customers moving their money has surged.

Customers are more sensitive to low deposit rates

So, what's the playbook for banks to tackle the uprising of disgruntled customers fed up with low interest rates? It's time to roll up your sleeves and get creative. Understanding and executing smart strategies could mean the difference between keeping your customers and watching them slip away.

It's time to make a move and fortify your institution against the unpredictable winds of customer preference.

According to the 2023 J.D. Power National Banking Satisfaction Study, customers with deposits totaling $10,000 or more are leading the charge in seeking better options. As customers open secondary accounts, their loyalty to their primary bank diminishes, presenting a significant risk to future business opportunities.

Effective Countermeasures

What can banks do to counteract dissatisfaction caused by low deposit interest rates? Understanding and implementing effective behaviors can make all the difference in retaining customers.

Now's the time to act and ensure your institution's resilience in the face of changing customer preferences.

Insights Sourced From