Customers have plenty of options when choosing an insurance carrier, and there is no shortage of advertising to remind them where to go to get a quote. Most carriers have added online quote and bind as a key digital feature, prominently displayed front and center on their website. Once a differentiator, this feature is now standard fare. Customers just expect it. And they expect it to simply work.

In the fight to differentiate, many carriers are turning to other digital technologies as well. But the question arises: are these differentiators or features? If you are approaching them as differentiators, buckle up because they can cause as much harm as good.

We see two main problems with treating digital technology as a differentiator rather than a feature:

- Insurance remains a low frequency interaction service—customers use digital capabilities on a one-off need basis. They don’t use the features regularly enough to go through the process of sorting out the bugs with you; they just expect that it works when they need it, or it doesn’t.

- By treating the feature as a differentiator, much pomp and circumstance is made of it ‘being offered’. As new digital technology features are embedded into old processes, some basic customer experience fundamentals are ignored in favor of highlighting the technology. This is a mistake.

Photo Estimate technology illustrates these concepts well. We use this as an illustrative case because there are two potential outcomes:

- Either photo is the only MOI required; or

- The photo needs to be supplemented with a standard MOI.

In theory, Photo Estimate should be a good alternative option; no appointments to schedule or time out of busy calendars to get an estimate, just send pictures and done. Faster, simpler, more convenient.

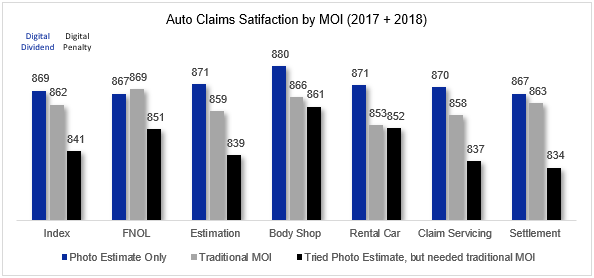

When you offer Photo Estimate as an MOI, and it works, you reap the Digital Dividend. Customers are highly satisfied, more so than customers who didn’t use Photo Estimate even when other parts of the claims process are not perfect. But when it goes wrong and another MOI is required to supplement the Photo Estimate, you pay the Digital Penalty. Customers become irritated and show significantly lower satisfaction across the entire claims process. Simply interjecting a new technology into an old process and highlighting and celebrating its presence is a risky proposition with a binary outcome. There is no neutral.

So what should we do? Using the Photo Estimate example, expectations must be appropriately set. If it is being offered, you should communicate that there is a possibility that the Photo Estimate alone will not be sufficient and that a supplemental physical inspection may be required. It is all about ensuring the customer knows what to expect throughout the process so there are no surprises when it comes to additional effort needed to complete the claim submission. Explaining the next steps in the process should a supplemental inspection be required goes even further to mitigating the Digital Penalty of supplements. Expectation setting and clearly articulating next steps are the two most important factors in ‘making the customer feel at ease’. Preparing for an unfavorable outcome from the outset can significantly reduce the potential for a poor experience at the hands of good technology.

The broader lesson to be learned is in the use of digital within processes. Whenever a new technology is identified and prepared for deployment, multiple outcomes need to be considered, both positive and negative. When everything goes right or when nothing goes right, how is my operation going to handle the situation? Perhaps more importantly, how are we going to know? With Photo Estimate, there is a clear point when the file owner or team notifies the customer for a supplemental inspection. But what about a customer service chatbot that fails to be helpful? What about an online quote that is really a monoline experience for a would-be bundler? The list can go on. But when things go south, the feature becomes a differentiator for all the wrong reasons.

Digital technology offers a great opportunity to create better customer experiences and more efficient operations, but it has to be deployed with customer outcomes in mind. It is an increasing expectation that digital features be present, but the feature alone isn’t enough. It has to work, especially in low frequency interactions. It has to make the process faster, simpler and more convenient. If it doesn’t, there is a penalty to pay.